Blockchain technology has revolutionized the way we think about data integrity, transparency, and trust in the digital age. At the heart of this transformative technology lies a process known as blockchain mining, a cornerstone of blockchain networks. In this article, we will delve into the intricacies of mining in blockchain networks, understanding its significance, and exploring the far-reaching implications it carries for the world of cryptocurrencies and beyond.

Definition of Blockchain Mining

Blockchain mining is the computational process by which new transactions are added to the blockchain, and the integrity and security of the entire network are maintained. This process involves solving complex mathematical puzzles using computational power. Successful miners, often referred to as “nodes,” are rewarded with cryptocurrency tokens for their efforts. These tokens serve as both an incentive for miners and as a means of securing the network.

Significance of Mining in Blockchain Networks

The significance of mining in blockchain networks cannot be overstated. It serves as the backbone of most blockchain systems and fulfills several critical roles:

- Transaction Validation: Mining plays a pivotal role in validating and verifying transactions within the network. When a user initiates a cryptocurrency transaction, it is added to a pool of unconfirmed transactions. Miners select transactions from this pool and include them in a new block, confirming their legitimacy.

- Security: Mining ensures the security and immutability of the blockchain. Miners compete to solve complex cryptographic puzzles, and the first one to solve it gets the right to add a new block of transactions to the chain. This competitive process, known as Proof of Work (PoW), makes it incredibly difficult for malicious actors to manipulate the blockchain.

- Decentralization: Mining contributes to the decentralization of blockchain networks. Unlike traditional centralized systems, where a single entity can control transactions, blockchain relies on a distributed network of miners, ensuring no single entity has excessive power or control.

- Creation of New Coins: In addition to validating transactions, miners are rewarded with newly created cryptocurrency tokens. This process, known as “coinbase transactions,” is how new coins are introduced into circulation. Miners are motivated by the potential financial rewards, making mining a competitive and dynamic ecosystem.

Purpose and Structure of the Article

This article aims to provide a comprehensive understanding of the role of mining in blockchain networks. We will explore how blockchain mining works, its importance, and the implications it holds for the cryptocurrency ecosystem. Additionally, we will examine the evolution of mining, including emerging technologies and sustainability concerns. By the end of this article, readers will gain insights into the inner workings of mining and its significance in shaping the future of blockchain technology.

How Blockchain Mining Works

Blockchain mining is a multifaceted process that underpins the integrity and functionality of blockchain networks. To comprehend its mechanics fully, let’s delve into the specifics, including the distinction between Proof of Work (PoW) and Proof of Stake (PoS) consensus mechanisms, and a step-by-step breakdown of the mining process.

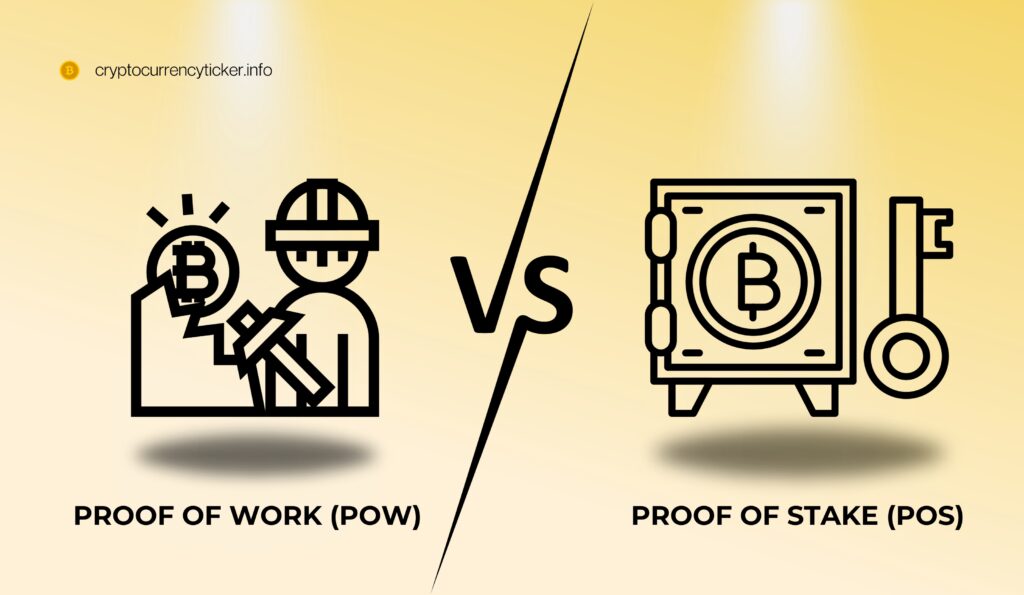

Proof of Work (PoW) vs. Proof of Stake (PoS)

- Proof of Work (PoW): PoW is the original and most widely used consensus mechanism in blockchain networks. In PoW, miners compete to solve complex cryptographic puzzles using computational power. The first miner to solve the puzzle gets the privilege of adding a new block to the blockchain. This process is resource-intensive and requires substantial energy consumption.

- Advantages of PoW:

- High security due to computational complexity.

- Decentralized, as miners must invest in hardware.

- Established and battle-tested (used in Bitcoin and Ethereum).

- Challenges of PoW:

- Energy-intensive, leading to environmental concerns.

- Limited scalability due to processing power constraints.

- Centralization risk as mining becomes more specialized.

- Advantages of PoW:

- Proof of Stake (PoS): PoS is an alternative consensus mechanism that aims to address some of the limitations of PoW. In PoS, validators (or “stakers”) are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This approach eliminates the need for resource-intensive mining and, theoretically, reduces energy consumption.

- Advantages of PoS:

- Energy-efficient, as it doesn’t rely on computational power.

- Scalable and environmentally friendly.

- Reduces centralization risk by removing hardware dependence.

- Challenges of PoS:

- Critics argue it may be less secure due to lower resource requirements.

- Potential wealth centralization as wealthier participants have more influence.

- Advantages of PoS:

Mining Nodes and Miners

In a blockchain network, nodes are computers connected to the network that validate and relay transactions. Miners, on the other hand, are specialized nodes responsible for participating in the mining process. Here’s a breakdown:

- Full Nodes: These nodes maintain a complete copy of the blockchain ledger, validate transactions, and relay information to other nodes. Full nodes play a vital role in ensuring the network’s transparency and security.

- Miners: Miners are a subset of nodes with the additional responsibility of mining new blocks. They select transactions from the pool of unconfirmed transactions, package them into a new block, and attempt to solve the cryptographic puzzle. Successful miners broadcast the new block to the network for verification.

The Mining Process Step-by-Step

Understanding the step-by-step process of blockchain mining provides insight into the meticulous work miners perform to secure and maintain the blockchain. Here’s a simplified overview:

- Transaction Pool: When a user initiates a cryptocurrency transaction, it enters a pool of unconfirmed transactions. Miners select transactions from this pool to include in the next block.

- Block Formation: Miners group selected transactions into a new block, creating a candidate block for addition to the blockchain.

- Proof of Work (PoW): In PoW-based networks like Bitcoin, miners compete to solve a cryptographic puzzle associated with the candidate block. The first miner to solve it broadcasts the solution to the network.

- Verification: Other nodes in the network verify the validity of the solution and the transactions within the candidate block.

- Consensus: Once a consensus is reached that the block is valid, it is added to the blockchain. The miner who solved the puzzle is rewarded with newly created cryptocurrency tokens, transaction fees, or both.

This step-by-step process ensures the continuous growth of the blockchain and the secure recording of transactions. In PoS-based networks, the process differs, with validators being chosen to create blocks based on their staked assets, eliminating the need for resource-intensive mining.

Importance of Mining in Blockchain Networks

The importance of mining in blockchain networks extends far beyond being a technical process. It serves as a foundational pillar that enables these networks to function securely, transparently, and autonomously. In this section, we will explore the critical roles played by mining in blockchain ecosystems.

Transaction Validation and Security

- Transaction Validation: Mining is the linchpin in the validation of transactions within blockchain networks. When users initiate transactions, they rely on miners to confirm and add these transactions to the blockchain. Without miners, transactions would remain in a state of limbo, lacking the essential validation required for them to be considered final.

- Network Security: Mining’s security function is paramount. It utilizes the competitive nature of miners to ensure that only valid transactions are included in the blockchain. The cryptographic puzzles miners solve are deliberately complex, making it practically impossible for malicious actors to manipulate the blockchain. This security feature is a fundamental reason why blockchain is trusted for secure transactions.

Decentralization and Trust

- Decentralization: One of the defining characteristics of blockchain networks is their decentralization. Unlike traditional centralized systems, where a single entity holds authority and control, blockchain relies on a distributed network of miners and nodes. This decentralization ensures that no single entity can exert undue influence or control over the network, enhancing trust and resilience.

- Trust: Mining engenders trust in blockchain networks. Users trust that their transactions will be validated fairly and that the blockchain’s immutable nature will protect their data from tampering. Miners, motivated by financial incentives, have a vested interest in maintaining the integrity of the network.

Incentives for Miners

- Financial Rewards: Miners are essential participants in the blockchain ecosystem because they are incentivized with rewards. In PoW-based networks, miners receive newly created cryptocurrency tokens (e.g., Bitcoin) and transaction fees for each block they successfully mine. These financial rewards motivate miners to invest in hardware and computational power.

- Network Maintenance: Miners are also responsible for ensuring the continuous operation and security of the network. Their active participation in mining and validation processes helps maintain the blockchain’s health and resilience.

Mining in blockchain networks plays a pivotal role in validating transactions, securing the network against malicious actors, and upholding the principles of decentralization and trust. Without mining, blockchain networks would lack the means to verify transactions and would be vulnerable to manipulation. As we move forward in this article, we will explore the broader implications of mining, including environmental concerns and scalability challenges, shedding light on the ongoing evolution of this critical aspect of blockchain technology.

Implications of Mining in the Cryptocurrency Ecosystem

The role of mining in blockchain networks extends beyond its technical functions. It has profound implications for the broader cryptocurrency ecosystem, influencing various aspects of technology, economics, and sustainability. In this section, we will explore these implications in detail.

Energy Consumption and Environmental Concerns

- Energy-Intensive Process: Mining, particularly in Proof of Work (PoW) blockchain networks like Bitcoin, is notorious for its energy consumption. Miners compete to solve complex puzzles, requiring substantial computational power. This energy-intensive process has raised concerns about its environmental impact.

- Carbon Footprint: The environmental footprint of PoW mining is significant. The energy consumed by miners is often generated from fossil fuels, contributing to carbon emissions. This has led to debates about the environmental sustainability of cryptocurrencies.

- Search for Alternatives: Due to growing environmental concerns, some blockchain projects are exploring alternative consensus mechanisms, such as Proof of Stake (PoS), which is more energy-efficient and eco-friendly.

Scalability Challenges

- Scalability Limitations: PoW-based blockchain networks face scalability challenges. The computational power required to mine new blocks limits the transaction processing capacity. As a result, these networks often struggle with slow transaction confirmations and high fees during periods of high demand.

- Efforts to Address Scalability: The scalability issue has prompted efforts to develop Layer 2 solutions, such as the Lightning Network for Bitcoin and sharding for Ethereum. These solutions aim to alleviate congestion on the main blockchain by processing transactions off-chain or in parallel.

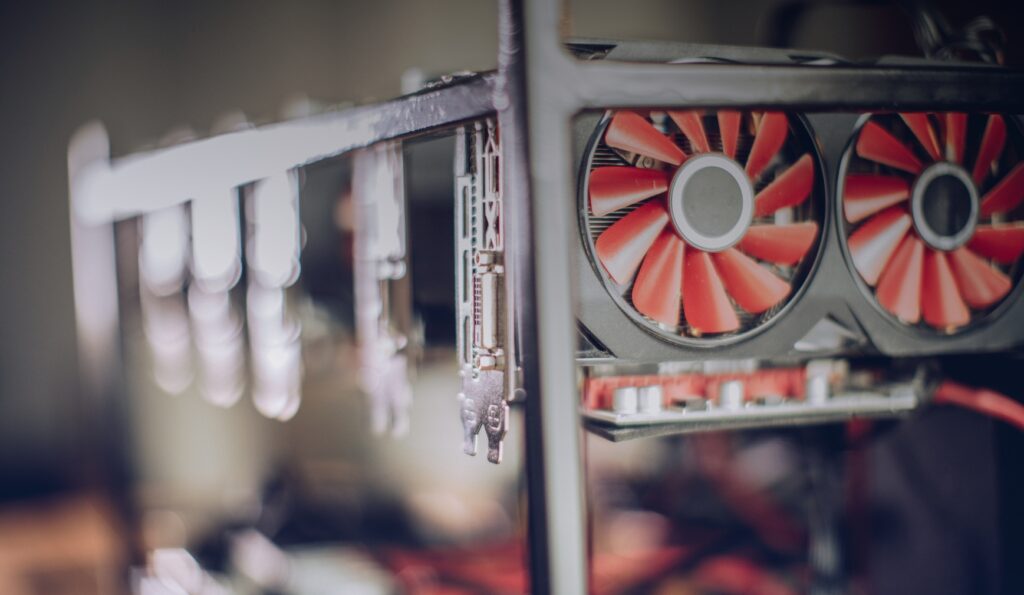

Competition and Centralization Trends

- Mining Pools: Mining has become highly competitive, leading to the emergence of mining pools. These pools combine the computational power of multiple miners to increase their chances of successfully mining new blocks. While this enhances the efficiency of mining, it also raises concerns about centralization, as large mining pools can dominate the network.

- Mining Hardware Advancements: Advances in mining hardware have made it increasingly specialized and expensive. This trend has led to concerns about centralization, as only well-funded entities can afford the latest mining equipment, potentially concentrating power in the hands of a few.

The implications of mining in the cryptocurrency ecosystem are multifaceted. While it plays a crucial role in transaction validation and network security, it also presents challenges related to energy consumption, scalability, and centralization. As blockchain technology continues to evolve, finding solutions to these challenges and achieving a balance between security, sustainability, and efficiency will be essential. In the following section, we will explore the evolving landscape of mining, including the emergence of alternative consensus mechanisms and efforts to make mining more sustainable.

The Evolution of Mining

The world of blockchain mining is in a constant state of flux, driven by technological innovations, environmental concerns, and the need to address the challenges posed by traditional Proof of Work (PoW) mining. In this section, we will delve into the evolving landscape of mining, including the emergence of alternative consensus mechanisms and efforts to make mining more sustainable.

Emergence of Alternative Consensus Mechanisms

- Proof of Stake (PoS): PoS has gained significant traction as an alternative to PoW. Instead of relying on computational power, PoS networks select validators based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This shift to a more energy-efficient model has been welcomed by those concerned about the environmental impact of PoW mining.

- Delegated Proof of Stake (DPoS): DPoS takes the PoS concept further by allowing token holders to vote for a smaller set of delegates who are responsible for validating transactions and creating new blocks. DPoS aims to improve network scalability and efficiency.

- Proof of Authority (PoA): PoA relies on the identity and reputation of validators to maintain the network. Validators are typically known entities, making PoA suitable for private or consortium blockchains.

Transition to Sustainable Mining

- Green Mining Initiatives: Environmental concerns surrounding PoW mining have prompted green mining initiatives. Some projects seek to power mining operations with renewable energy sources like solar and wind, reducing their carbon footprint.

- Efficiency Improvements: Mining hardware manufacturers continuously work on developing more energy-efficient mining equipment. This not only reduces energy consumption but also lowers the barrier to entry for smaller miners.

Regulatory and Legal Considerations

- Regulation of Mining: Governments and regulatory bodies around the world are taking a closer look at mining operations. Some regions have imposed regulations to ensure that mining activities comply with environmental standards and taxation laws.

- Legal Challenges: The legal landscape surrounding mining is evolving. Disputes over mining operations, ownership of mined assets, and environmental impact can result in legal challenges that shape the industry’s future.

The evolution of mining is driven by a desire for sustainability, scalability, and improved efficiency. While PoW remains a fundamental part of many blockchain networks, the emergence of alternative consensus mechanisms and a growing focus on environmental responsibility are reshaping the mining landscape. As we look ahead, the future of mining may involve a diverse range of consensus models and environmentally friendly practices.

Future Prospects and Innovations in Blockchain Mining

The world of blockchain mining is poised for exciting developments as the industry seeks to address its challenges and enhance its capabilities. In this section, we will explore the future prospects and innovations in blockchain mining, including the role of Layer 2 solutions, the adoption of Proof of Stake (PoS), and the pursuit of interoperability in cross-chain mining.

Layer 2 Solutions and Off-Chain Scaling

- The Lightning Network (Bitcoin): The Lightning Network is a Layer 2 solution for Bitcoin designed to address its scalability issues. It allows for faster and cheaper transactions by conducting most transactions off-chain while periodically settling them on the main Bitcoin blockchain.

- Ethereum 2.0 (Eth2): Ethereum, one of the most popular blockchain platforms, is transitioning to Ethereum 2.0, which includes a shift from PoW to PoS consensus. This transition aims to improve scalability, reduce energy consumption, and enhance the overall efficiency of the network.

Proof of Stake (PoS) Adoption

- Ethereum’s PoS Transition: Ethereum’s move to PoS is a significant milestone in the blockchain industry. Ethereum 2.0, also known as Eth2 or Serenity, is expected to fully implement PoS, reducing the energy footprint of Ethereum mining and increasing its transaction throughput.

- Other PoS-Based Networks: Beyond Ethereum, numerous blockchain projects are adopting PoS or similar consensus mechanisms. These networks emphasize energy efficiency and scalability while maintaining security and decentralization.

Interoperability and Cross-Chain Mining

- Cross-Chain Solutions: Cross-chain technology is gaining prominence, allowing different blockchain networks to communicate and share data. This opens up possibilities for cross-chain mining, where miners can participate in multiple blockchain networks simultaneously.

- Interoperability Protocols: Projects like Polkadot, Cosmos, and Binance Smart Chain are working on interoperability protocols that enable assets and data to move seamlessly between blockchains. This enhances the flexibility and utility of blockchain networks.

Regulatory and Ethical Considerations

- Environmental Responsibility: As mining continues to evolve, there will likely be increased focus on environmentally responsible mining practices. Governments, industries, and miners themselves are likely to take steps to reduce the carbon footprint of mining operations.

- Regulation and Compliance: As the blockchain industry matures, regulatory frameworks for mining and related activities may become more standardized. Compliance with these regulations will be a key consideration for miners and mining operations.

The future of blockchain mining is marked by innovation, sustainability, and adaptability. Layer 2 solutions, the transition to PoS, and the pursuit of interoperability are shaping the industry’s trajectory. Additionally, ethical and regulatory considerations are becoming increasingly important as the industry gains prominence. As we navigate this evolving landscape, the world of blockchain mining is poised to play a pivotal role in shaping the future of decentralized technology.

Conclusion

In conclusion, mining stands as the bedrock of blockchain networks, integral to their security, transparency, and decentralization. Its significance transcends technicality, encompassing environmental responsibility, scalability, and the ever-evolving quest for innovation. The industry’s shift towards sustainability through PoS adoption, Layer 2 solutions, and cross-chain interoperability reflects its commitment to a more efficient and interconnected future. Mining’s enduring importance guarantees its central role in shaping the evolution of blockchain technology, where adaptation and innovation continue to fuel the industry’s growth and potential.