Cryptocurrency mining is the backbone of many blockchain networks, serving as the mechanism that validates transactions, secures the network, and issues new tokens. Over the years, the technology behind crypto mining has evolved significantly, transforming from a simple process conducted on central processing units (CPUs) to the highly specialized and efficient application-specific integrated circuits (ASICs) we see today. In this article, we will embark on a journey through time to explore the fascinating evolution of crypto mining technology.

The Early Days of CPU Mining

In the early days of cryptocurrencies, mining was a novel concept that required little more than a computer with a CPU. In fact, Satoshi Nakamoto, the creator of Bitcoin, envisioned mining as a way for ordinary individuals to participate in network security and earn rewards.

CPU mining, as the name suggests, relied on the processing power of the central unit of a computer. Miners would install mining software on their PCs, and the CPU would perform the necessary cryptographic calculations to validate transactions and create new blocks. This process was relatively simple and accessible to anyone with a computer.

Challenges and Limitations of CPU Mining

While CPU mining was an egalitarian approach to cryptocurrency mining, it was not without its challenges and limitations:

- Inefficiency: CPUs were not designed specifically for mining, making them inefficient at performing the complex cryptographic calculations required by cryptocurrency networks. As a result, CPU miners had to compete with each other to solve mathematical puzzles, leading to a race that consumed significant computational resources.

- Low Hashpower: CPUs had limited hashpower, which is a measure of their mining capabilities. This meant that CPU miners had a relatively low chance of successfully mining a block, especially as the network difficulty increased.

- Centralization: As cryptocurrency gained popularity, individuals with access to powerful hardware or data centers began to dominate the network. This centralization of mining power went against the decentralized ethos of cryptocurrencies.

The Birth of Bitcoin and Its CPU-Mining Phase

Bitcoin, the first cryptocurrency, was mined exclusively using CPUs during its early days. Miners ran Bitcoin’s open-source software on their computers, and the CPU was sufficient to mine blocks. At this stage, Bitcoin was virtually unknown, and mining was an enthusiast’s hobby rather than a lucrative industry.

Bitcoin’s CPU mining phase allowed early adopters to accumulate significant amounts of the cryptocurrency with little competition. However, as Bitcoin gained recognition and its value increased, the limitations of CPU mining became evident. It was clear that a more efficient and scalable approach was needed to sustain the network and accommodate the growing interest in cryptocurrency.

GPU Mining: A Game-Changer

The limitations of CPU mining paved the way for a significant advancement in cryptocurrency mining technology – the introduction of graphics processing units (GPUs). GPUs, originally designed for rendering graphics in video games and other graphics-intensive applications, turned out to be a game-changer in the world of crypto mining.

Emergence of GPU Mining as a More Efficient Alternative

GPUs offered several advantages over CPUs when it came to mining cryptocurrencies:

- Parallel Processing: Unlike CPUs, which are optimized for sequential processing tasks, GPUs excel at parallel processing. This means they can perform multiple calculations simultaneously, making them highly efficient for the repetitive and parallelizable calculations required in crypto mining.

- Increased Hashpower: The parallel processing capabilities of GPUs significantly increased their hashpower compared to CPUs. This resulted in a higher probability of successfully mining cryptocurrency blocks.

- Mining Software Optimizations: Developers quickly recognized the potential of GPUs for mining and started creating mining software optimized for these graphics cards. This further improved mining efficiency.

Why GPUs Outperformed CPUs in Mining

To understand why GPUs outperformed CPUs in mining, it’s essential to grasp the core concept of mining in cryptocurrency networks. Miners compete to solve complex cryptographic puzzles, and the first one to solve it gets to add a new block to the blockchain and receives a reward. This process is known as proof-of-work (PoW).

GPUs, with their parallel processing capabilities, could attempt many solutions to the puzzle simultaneously. This dramatically increased their chances of being the first to find the correct solution and secure the block reward. In contrast, CPUs, which processed tasks sequentially, struggled to keep up with the computational demand of cryptocurrency mining.

The Impact on the Mining Community and Decentralization

The introduction of GPU mining had profound effects on the cryptocurrency mining community and the networks themselves:

- Wider Participation: GPU mining made it feasible for a more extensive and diverse group of individuals to participate in cryptocurrency mining. It was no longer limited to tech-savvy enthusiasts with high-end CPUs.

- Decentralization: With a broader pool of miners and less reliance on specialized hardware, GPU mining contributed to the decentralization of cryptocurrency networks. This aligns with the original vision of cryptocurrencies as decentralized, trustless systems.

- Network Security: The increased hashpower from GPU mining improved the security of cryptocurrency networks. A network with more miners and greater computational power is less susceptible to attacks.

FPGA Miners: The Middle Ground

Field-Programmable Gate Arrays (FPGAs) marked a pivotal point in the evolution of cryptocurrency mining technology. Positioned between GPUs and the later-to-come ASICs, FPGAs introduced a level of flexibility and efficiency that had not been seen before.

Introduction to Field-Programmable Gate Arrays (FPGAs)

FPGAs are semiconductor devices that can be reprogrammed to perform specific tasks, including cryptocurrency mining. Unlike CPUs and GPUs, which have fixed architectures optimized for general-purpose computing, FPGAs can be configured to execute the exact algorithms required for mining a particular cryptocurrency.

Miners could program FPGAs to implement the hashing algorithms used by cryptocurrencies like Bitcoin, Litecoin, and others. This level of customization made FPGAs significantly more efficient than CPUs and somewhat competitive with GPUs.

How FPGAs Bridged the Gap Between GPUs and ASICs

FPGAs bridged the gap between GPUs and Application-Specific Integrated Circuits (ASICs) in several ways:

- Customization: While FPGAs did not match the extreme specialization of ASICs, they allowed miners to tailor their hardware to the specific mining algorithm of a cryptocurrency. This customization provided a substantial boost in efficiency over general-purpose CPUs and GPUs.

- Energy Efficiency: FPGAs offered improved energy efficiency compared to GPUs and CPUs. They consumed less power while delivering competitive mining performance, making them a more environmentally friendly option.

- Competitive Advantage: Miners who adopted FPGAs gained a competitive edge over those relying solely on CPUs and GPUs. The ability to fine-tune hardware for specific algorithms allowed for higher hash rates and more profitable mining operations.

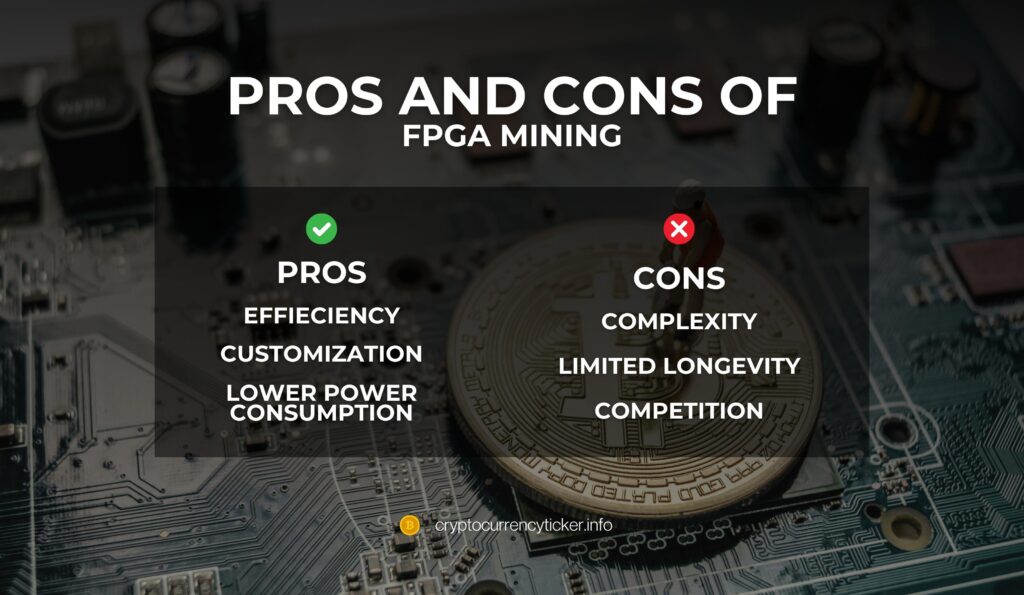

Pros and Cons of FPGA Mining

FPGA mining came with its own set of advantages and limitations:

Pros:

- Efficiency: FPGAs struck a balance between the flexibility of GPUs and the specialization of ASICs, offering superior efficiency for mining specific cryptocurrencies.

- Customization: Miners had the flexibility to adapt their FPGAs to various cryptocurrencies, making them versatile and adaptable to changes in the crypto landscape.

- Lower Power Consumption: FPGAs consumed less electricity compared to GPUs and CPUs, reducing operating costs and environmental impact.

Cons:

- Complexity: Programming and configuring FPGAs required technical expertise, which could be a barrier for some miners.

- Limited Longevity: FPGAs, while efficient, still faced the risk of becoming obsolete as more specialized ASICs emerged.

- Competition: As more miners adopted FPGAs, the competition increased, making it harder for individual miners to maintain profitability.

Rise of ASIC Mining

The introduction of Application-Specific Integrated Circuits (ASICs) marked a monumental shift in the world of cryptocurrency mining. ASICs are highly specialized hardware devices explicitly designed to perform a single task, and they brought unprecedented levels of efficiency to the mining process.

Explanation of Application-Specific Integrated Circuits (ASICs)

ASICs are purpose-built chips optimized for a specific computational task. In the context of cryptocurrency mining, ASICs are designed to execute the hashing algorithms required to validate transactions and create new blocks. Unlike CPUs, GPUs, and FPGAs, which are versatile and can handle a wide range of tasks, ASICs focus exclusively on mining.

Why ASICs Revolutionized Crypto Mining

The key factors that made ASICs a game-changer in the crypto mining industry include:

- Unprecedented Efficiency: ASICs are incredibly efficient at performing the specific calculations needed for mining. Their high hash rates far surpass those of CPUs, GPUs, and FPGAs, resulting in significantly faster and more profitable mining operations.

- Lower Power Consumption: ASICs consume considerably less electricity per hash than other mining hardware, reducing operational costs and environmental impact.

- Mining Dominance: The efficiency and hashpower of ASICs led to their widespread adoption. In many cryptocurrency networks, ASIC miners now dominate, and the difficulty of mining has skyrocketed as a result.

- Competitive Advantage: Miners using ASICs gained a substantial competitive advantage. Their ability to mine more blocks and earn more rewards made it increasingly challenging for CPU, GPU, and FPGA miners to remain profitable.

ASICs’ Dominance and Centralization Concerns

While ASICs brought undeniable benefits to the efficiency of cryptocurrency mining, they also raised significant concerns about centralization:

- Entry Barriers: ASICs are expensive and require significant upfront investments. This high barrier to entry meant that only well-funded individuals and large mining farms could afford to purchase and operate ASIC mining equipment.

- Centralization of Mining Pools: ASICs contributed to the consolidation of mining power into larger mining pools and data centers, further centralizing control over cryptocurrency networks.

- Network Security: As mining power became concentrated in the hands of a few, the security of some cryptocurrency networks was jeopardized. A large-scale attack by a single entity became a plausible threat.

The dominance of ASICs ignited debates within the crypto community about the trade-offs between efficiency and decentralization. Some cryptocurrencies sought to maintain ASIC resistance, while others embraced ASIC mining as a means to improve network security.

Challenges and Controversies

The ascent of ASIC mining technology in the cryptocurrency space brought with it a set of challenges and controversies that have significantly shaped the industry’s landscape. In this section, we will explore some of the most pressing issues associated with ASIC mining.

Environmental Concerns and Energy Consumption

One of the most prominent criticisms of ASIC mining is its substantial energy consumption. ASIC miners, while highly efficient in terms of hashpower, require substantial amounts of electricity to operate. This energy-intensive nature has drawn attention to the environmental impact of large-scale mining operations, especially those powered by non-renewable energy sources.

The concentration of mining power in regions with cheap electricity, often from fossil fuels, has raised concerns about the carbon footprint of cryptocurrency networks. Critics argue that the environmental consequences of ASIC mining could undermine the eco-friendly aspirations of many cryptocurrencies.

ASIC Resistance and the Desire for Decentralization

In response to the centralization concerns posed by ASICs, some cryptocurrencies have taken steps to maintain ASIC resistance. ASIC resistance refers to the intentional design of hashing algorithms to be resistant to optimization by ASIC hardware.

The goal of ASIC resistance is to ensure that mining remains accessible to a broader range of participants and prevents the dominance of a few mining entities. Cryptocurrencies like Ethereum have actively pursued ASIC resistance as part of their ethos of decentralization.

However, achieving ASIC resistance is an ongoing battle, as hardware manufacturers continually strive to adapt and develop ASICs tailored to new algorithms. This cat-and-mouse game between developers and ASIC manufacturers underscores the importance of maintaining a balance between mining efficiency and decentralization.

The Impact on Cryptocurrency Networks and Consensus Algorithms

The prevalence of ASIC mining has influenced the dynamics of various cryptocurrency networks and even led to debates over changes to consensus algorithms. In some cases, networks have undergone hard forks to alter their mining algorithms in response to ASIC dominance.

These changes aim to restore a level playing field for miners and promote network decentralization. However, they also carry risks, such as potential network splits and disagreements within the community over the direction of the cryptocurrency.

The Future of Crypto Mining Technology

The evolution of crypto mining technology continues, driven by a relentless pursuit of efficiency, sustainability, and decentralization. In this section, we will explore what the future may hold for cryptocurrency mining.

Innovations in Mining Hardware

As the cryptocurrency industry matures, innovations in mining hardware are expected to play a crucial role in improving mining efficiency and reducing energy consumption. Here are some areas where innovations are likely to emerge:

- Advanced ASIC Designs: Manufacturers are continually developing more efficient and powerful ASIC miners. These designs may include features like improved power management, increased hash rates, and enhanced cooling solutions.

- Customizable Hardware: Some projects are exploring customizable hardware that can adapt to different mining algorithms. This could potentially extend the lifespan of mining equipment and reduce the need for frequent hardware upgrades.

- Hybrid Mining Solutions: Combining different types of hardware, such as ASICs, GPUs, and FPGAs, in a single mining rig may become more common. This hybrid approach allows miners to optimize their hardware for specific tasks and algorithms.

The Quest for Greener and More Sustainable Mining Solutions

The environmental impact of cryptocurrency mining has become a growing concern. Miners and projects are actively seeking greener and more sustainable mining solutions:

- Renewable Energy: Some mining operations are transitioning to renewable energy sources like solar and wind power to reduce their carbon footprint. Green mining initiatives aim to make mining more environmentally friendly.

- Proof-of-Stake (PoS): PoS cryptocurrencies, such as Ethereum’s transition to Ethereum 2.0, eliminate the energy-intensive proof-of-work mining altogether. PoS relies on validators who lock up cryptocurrency as collateral to secure the network.

- Carbon Offsetting: Mining projects are exploring options to offset their carbon emissions through various environmental initiatives and partnerships.

Speculations on the Next Evolution in Mining Technology

Predicting the exact path of mining technology evolution is challenging, but several trends and possibilities are worth considering:

- Quantum Computing: The advent of quantum computers could disrupt existing mining algorithms and require new cryptographic solutions. Cryptocurrency projects are already researching quantum-resistant algorithms to prepare for this eventuality.

- Decentralized Mining Pools: Decentralized mining pools and protocols may emerge, allowing miners to join forces without relying on centralized intermediaries. These solutions aim to enhance network security and reduce the power of large mining pools.

- Regulatory Influences: Regulatory developments in various countries can significantly impact mining operations. Governments may introduce policies that encourage or discourage mining activities, affecting the industry’s geographical distribution.

Conclusion

In conclusion, the evolution of cryptocurrency mining technology, from its humble beginnings with CPU mining to the dominance of specialized ASICs, underscores the dynamic nature of the industry. This journey has seen remarkable advancements, challenges, and debates, reflecting the core values of efficiency, decentralization, and sustainability. As we look to the future, the cryptocurrency mining landscape will undoubtedly witness further innovations, sustainable practices, and potential shifts in consensus mechanisms, all in pursuit of a more efficient, equitable, and environmentally responsible crypto mining ecosystem.