In the ever-evolving world of cryptocurrencies, Bitcoin stands as the undisputed pioneer. Since its inception in 2009, Bitcoin has captured the imagination of investors, traders, and the general public alike. Its meteoric rise in value and recognition as a digital gold standard have made it a cornerstone of many crypto portfolios. However, as the crypto market matures, the importance of diversification becomes increasingly evident.

The Growing Importance of Diversification in the Crypto Market

Bitcoin’s dominance in the crypto market is unquestionable. It has consistently held the lion’s share of the total cryptocurrency market capitalization, often exceeding 60% or more. While Bitcoin has proven itself as a store of value and a digital asset worth holding, the crypto landscape has evolved to offer a multitude of alternative investment opportunities in the form of altcoins.

The Dominance of Bitcoin and the Need for Alternatives

Bitcoin’s dominance, often referred to as Bitcoin’s dominance index, measures its market capitalization as a percentage of the total cryptocurrency market capitalization. While Bitcoin’s dominance provides a valuable snapshot of its market share, it doesn’t necessarily reflect the entire crypto market’s health or potential.

As of my last knowledge update in January 2022, Bitcoin’s dominance index had fluctuated but remained above 60% for an extended period. However, the cryptocurrency market had witnessed remarkable growth and diversification in the years leading up to that point.

The need for diversification stems from several factors:

- Reducing Risk: Bitcoin, like all cryptocurrencies, is subject to market volatility. Diversifying your portfolio can help mitigate the impact of price fluctuations in any single asset.

- Unlocking New Opportunities: The crypto market is teeming with innovative projects and technologies beyond Bitcoin. Diversification allows you to tap into these opportunities and potentially benefit from their growth.

- Enhancing Returns: While Bitcoin can provide substantial returns, some altcoins have shown the potential for even more significant gains. By diversifying, you can take advantage of various assets with unique growth prospects.

- Staying Informed: Diversification requires ongoing research and monitoring, which can help you stay updated on the latest developments in the crypto space.

| Section | Content |

|---|---|

| Introduction | This article aims to be your comprehensive guide to diversifying your crypto trading portfolio by incorporating altcoins. |

| It will delve into the benefits of diversification, strategies for achieving it, and highlight some of the top altcoins | |

| worth considering. Additionally, we will address the associated risks and challenges, equipping you with the knowledge | |

| needed to make informed decisions in your cryptocurrency investment journey. |

The Benefits of Diversifying Your Crypto Portfolio

Diversifying your crypto portfolio holds a multitude of advantages that can positively impact your investment strategy and financial outcomes. In this section, we’ll delve into these benefits, emphasizing why diversification is a crucial aspect of crypto trading.

1. Risk Management and Reduction

The crypto market is renowned for its volatility, with prices that can experience rapid fluctuations within a short span. Bitcoin, although resilient, is not exempt from this characteristic. Diversification is your shield against the inherent risk of a single asset dominating your portfolio.

By spreading your investments across different cryptocurrencies, you can reduce the impact of a sudden price crash in one particular coin. If Bitcoin, for example, experiences a significant downturn, having diversified into other assets can help mitigate your losses. This risk mitigation strategy is akin to the age-old saying of not putting all your eggs in one basket.

2. Potential for Enhanced Returns

While Bitcoin has proven to be a lucrative investment for many, the crypto market is dynamic and constantly evolving. Diversifying your portfolio allows you to tap into the diverse growth potentials of various cryptocurrencies.

Some altcoins, often with smaller market capitalizations compared to Bitcoin, have shown the potential for exponential gains. These opportunities arise due to technological innovations, adoption by specific industries, or unique features that set them apart from Bitcoin. By diversifying, you can participate in these potential high-return opportunities while still holding Bitcoin as a stable store of value.

3. Exposure to Innovative Blockchain Technologies

Beyond Bitcoin’s primary use case as digital gold, the blockchain industry continues to innovate. Numerous altcoins are pioneering groundbreaking technologies and applications that extend far beyond simple currency use.

Diversification grants you exposure to these innovative blockchain technologies. For instance, Ethereum, often considered the second-largest cryptocurrency by market capitalization, introduced the concept of smart contracts and decentralized applications (DApps). Other platforms like Cardano, Solana, and Polkadot are pushing the boundaries of blockchain technology in various ways, including scalability, interoperability, and sustainability.

Understanding Altcoins

Altcoins, short for “alternative coins,” constitute a diverse group of cryptocurrencies that are not Bitcoin. In this section, we’ll explore the concept of altcoins, delve into the different categories they fall into, and examine their significance in a diversified crypto portfolio.

What Are Altcoins?

Altcoins are any cryptocurrencies other than Bitcoin. They emerged in the wake of Bitcoin’s success, often seeking to address specific limitations or introduce novel features not present in Bitcoin’s design. The term “altcoin” encompasses a vast array of digital currencies, each with its unique attributes and purposes.

While Bitcoin serves primarily as a decentralized digital currency and store of value, altcoins have expanded the possibilities of blockchain technology. They include cryptocurrencies designed for diverse use cases, such as enabling smart contracts, facilitating fast and low-cost transactions, providing privacy features, and supporting unique governance models.

Different Categories of Altcoins

Altcoins can be categorized into several groups based on their underlying technology and purpose. Some common categories include:

- Smart Contract Platforms: These altcoins, like Ethereum, enable the creation of decentralized applications (DApps) and smart contracts. They form the foundation of the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

- Privacy Coins: Privacy-focused altcoins, such as Monero (XMR) and Zcash (ZEC), emphasize anonymity and confidentiality in transactions. They offer enhanced privacy features compared to Bitcoin.

- Payment Coins: Coins like Litecoin (LTC) and Bitcoin Cash (BCH) aim to improve upon Bitcoin’s transaction speed and cost-effectiveness, making them suitable for everyday transactions.

- Governance Tokens: These tokens, often associated with decentralized autonomous organizations (DAOs), enable token holders to participate in network governance decisions. Examples include Maker (MKR) and Compound (COMP).

- Stablecoins: Stablecoins like Tether (USDT) and USD Coin (USDC) are designed to maintain a stable value by pegging it to a reserve asset, typically a fiat currency like the US dollar.

Altcoin Market Dynamics and Trends

The altcoin market operates in tandem with Bitcoin but exhibits its unique dynamics. Altcoins often experience more significant price fluctuations compared to Bitcoin due to their smaller market capitalizations and liquidity. This volatility can present both opportunities and risks for investors.

Understanding these market dynamics and staying informed about the latest trends in the altcoin space is crucial for effective diversification. In the subsequent sections, we’ll explore strategies for diversifying your crypto portfolio, providing you with actionable insights to construct a well-balanced investment strategy.

Strategies for Effective Crypto Portfolio Diversification

Diversifying your crypto portfolio involves more than just spreading your investments randomly. In this section, we will discuss strategic approaches to diversification that can help you optimize your portfolio for risk management and potential returns.

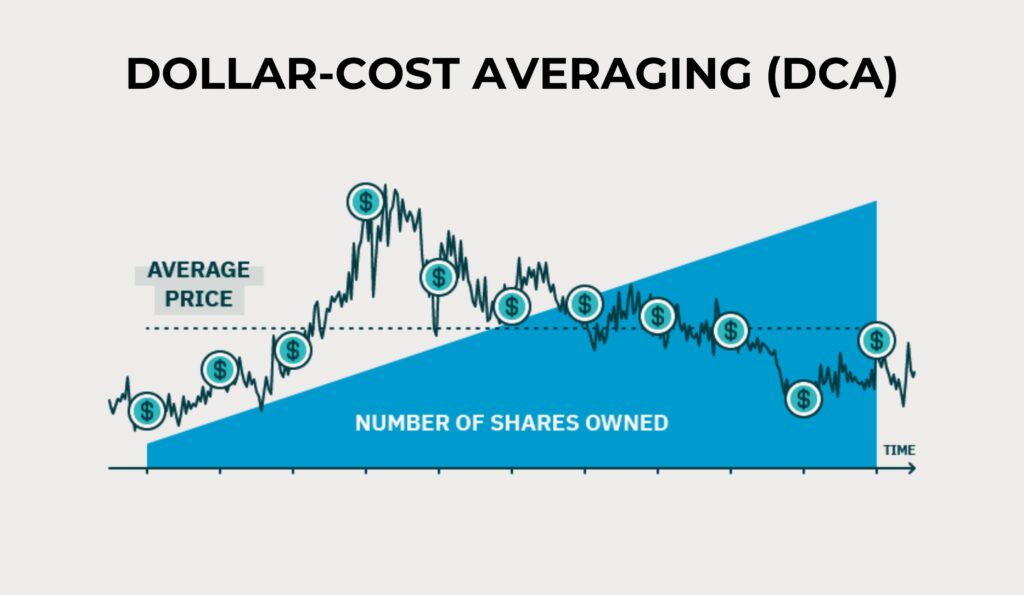

Dollar-Cost Averaging (DCA) and Its Advantages

Dollar-Cost Averaging (DCA) is a time-tested investment strategy that can be particularly effective in the volatile world of cryptocurrencies. Instead of making a lump-sum investment, DCA involves regularly investing a fixed amount of money at predefined intervals, regardless of the asset’s price.

The advantages of DCA in crypto portfolio diversification include:

- Risk Mitigation: DCA spreads your investment over time, reducing the risk of entering the market at a peak price.

- Emotional Discipline: It helps you avoid impulsive decisions driven by market fluctuations and emotions.

- Consistency: DCA encourages consistent saving and investment, regardless of short-term market movements.

Market Capitalization-Based Allocation Strategies

Allocating your crypto investments based on market capitalization is another effective diversification strategy. This involves distributing your investments across cryptocurrencies based on their market size relative to the total cryptocurrency market.

For example, you might allocate a significant portion to Bitcoin due to its dominant market position. However, you would allocate smaller portions to mid-cap and smaller-cap coins to achieve a balanced allocation.

Sector-Based Diversification: Exploring Various Niches

Sector-based diversification involves investing in cryptocurrencies within specific sectors or industries. For instance, you might allocate a portion of your portfolio to DeFi (Decentralized Finance) coins, which are cryptocurrencies that support financial services like lending, borrowing, and trading without traditional intermediaries.

Other sectors to consider include NFTs (Non-Fungible Tokens), privacy coins, gaming tokens, and supply chain solutions. Diversifying across sectors can help you tap into various growth opportunities and reduce sector-specific risks.

Geographic Diversification for Global Exposure

Cryptocurrencies are a global asset class, and their adoption and regulation can vary significantly by region. Geographic diversification involves investing in cryptocurrencies that are prominent in different geographical areas.

For example, you might consider investments in Asian-focused cryptocurrencies like Binance Coin (BNB) or projects with a strong presence in Europe or the Americas. This strategy can help you mitigate region-specific risks and benefit from diverse regulatory environments.

Top Altcoins for Diversification

Diversifying your crypto portfolio involves selecting the right altcoins to complement your Bitcoin holdings. In this section, we will introduce you to some of the top altcoins worth considering, each with its unique features and growth potential.

Ethereum (ETH)

Ethereum is often hailed as the pioneer of smart contracts and decentralized applications (DApps). Here are some key reasons why Ethereum is a compelling choice for diversification:

Smart Contracts and DeFi Dominance: Ethereum’s smart contract capabilities have fueled the explosive growth of decentralized finance (DeFi) applications. DeFi platforms enable activities like lending, borrowing, and yield farming without traditional intermediaries.

Ethereum 2.0 Upgrade: Ethereum is undergoing a significant upgrade to Ethereum 2.0, which promises to improve scalability, security, and energy efficiency. This upgrade could further solidify Ethereum’s position in the crypto ecosystem.

Cardano (ADA)

Cardano is known for its emphasis on scientific research, sustainability, and scalability. Here’s why it’s a noteworthy choice for diversification:

- Transition to Proof of Stake (PoS): Cardano uses a PoS consensus mechanism, which is more energy-efficient and environmentally friendly compared to Bitcoin’s Proof of Work (PoW). This transition aligns with growing sustainability concerns in the crypto space.

- Smart Contract Capabilities: Cardano’s Alonzo upgrade introduced smart contract functionality, enabling developers to build DApps on the Cardano blockchain. This positions Cardano as a competitor in the DeFi and NFT sectors.

Solana (SOL)

Solana has gained significant attention for its high throughput and low transaction fees. Here’s why it’s a standout choice for diversification:

Exceptional Throughput and Low Fees: Solana’s unique architecture enables it to process a high volume of transactions at a fraction of the cost compared to some other blockchains. This scalability is attractive for applications that require fast and cost-effective transactions.

Growing DeFi Ecosystem: Solana’s blockchain has become a hub for DeFi projects, attracting decentralized exchanges, lending platforms, and NFT marketplaces. Its expanding ecosystem offers diverse investment opportunities.

Polkadot (DOT)

Polkadot is known for its focus on interoperability and cross-chain compatibility. Here’s why it’s a noteworthy addition to a diversified portfolio:

- Interoperability Features: Polkadot’s architecture allows different blockchains to connect and share information, enabling cross-chain communication. This interoperability is crucial for the future of blockchain networks.

- Parachains and Cross-Chain Compatibility: Polkadot introduces the concept of parachains, which are specialized blockchains that can be customized for various purposes. This flexibility and cross-chain compatibility make Polkadot a promising platform for a wide range of applications.

Risks and Challenges in Altcoin Diversification

While altcoin diversification can offer numerous benefits, it’s essential to be aware of the potential risks and challenges that come with it. In this section, we’ll explore these factors to help you make informed decisions in managing your diversified crypto portfolio.

Volatility and Price Fluctuations

Altcoins, especially those with smaller market capitalizations, are often more volatile than Bitcoin. Rapid price fluctuations can lead to substantial gains, but they can also result in significant losses. It’s crucial to recognize that the potential for higher returns comes hand in hand with increased risk.

To mitigate this risk:

- Set clear entry and exit strategies.

- Stay informed about the latest news and developments related to your chosen altcoins.

- Consider using stop-loss orders to limit potential losses during market downturns.

Regulatory Concerns

The regulatory landscape for cryptocurrencies is evolving, and regulations can vary significantly by jurisdiction. Altcoins may face regulatory challenges that could impact their use, trading, and overall value.

To address regulatory concerns:

To stay on top of the regulatory landscape in your area, invest in projects that prioritize transparency and compliance. Additionally, be ready for any regulatory shifts that could impact your portfolio.

Security Risks and Scams

The crypto space has witnessed its fair share of security breaches and scams. Some altcoin projects have turned out to be fraudulent or poorly designed, resulting in the loss of investor funds.

To protect yourself against security risks and scams:

- Conduct thorough research before investing in any altcoin.

- Verify the legitimacy of the project’s team and its technology.

- Use reputable cryptocurrency exchanges and wallets to store your assets securely.

- Beware of phishing attempts and fraudulent schemes.

Conclusion

In the dynamic and ever-evolving realm of cryptocurrencies, diversifying your portfolio by incorporating altcoins can be a strategic move that aligns with your investment goals. As we’ve explored in this article, diversification offers numerous advantages, including risk reduction, the potential for enhanced returns, and exposure to innovative blockchain technologies. Altcoins, each with its unique features and growth potential, can complement Bitcoin in your portfolio.

Balancing your crypto investments between Bitcoin and carefully chosen altcoins requires thoughtful consideration, research, and a disciplined approach. It’s vital to recognize the risks and challenges that come with altcoin diversification, including volatility, regulatory concerns, and security risks, and take steps to mitigate them. Staying informed, adaptable, and continuously learning about the cryptocurrency market will empower you to make well-informed decisions as you navigate your crypto investment journey. Remember, diversification is not just a strategy; it’s a journey toward building a resilient and well-rounded crypto portfolio.