In the ever-changing world of digital assets and blockchain technology, token sales have emerged as a pivotal element, reshaping how we perceive investment, ownership, and value exchange in the digital realm. This transformation isn’t just a fleeting trend; it’s a fundamental shift in the financial landscape, signaling a new era of digital finance.

The Current State of Token Sales

Token sales, commonly referred to as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), or simply token launches, have seen a meteoric rise in popularity and utility. Initially, these sales were primarily associated with cryptocurrencies and blockchain startups, offering a novel way to raise capital and engage a global investor base. However, the scope and reach of token sales have dramatically expanded.

Today, token sales encompass a vast array of digital assets, from utility tokens that grant access to specific services, to security tokens representing ownership in real-world assets, and even Non-Fungible Tokens (NFTs) that offer unique digital ownership experiences. The diversity and flexibility of token sales have attracted a broad spectrum of industries, including art, real estate, entertainment, and more.

A Brief History of Tokenization

The concept of tokenization isn’t new but has gained significant traction in recent years, thanks to blockchain technology. In essence, tokenization involves converting rights to an asset into a digital token on a blockchain. The genesis of tokenization can be traced back to the early days of Bitcoin, where the primary focus was on creating a decentralized digital currency. However, the introduction of Ethereum and its smart contract capabilities expanded the horizon, allowing for the creation of various types of tokens, each with distinct properties and uses.

This evolution from a single-purpose cryptocurrency to a multifaceted ecosystem of digital tokens marks a significant milestone in the history of blockchain and digital assets. It paved the way for innovative methods of fundraising, investing, and asset management, revolutionizing traditional financial systems and creating a more inclusive and accessible economic landscape.

| Aspect | Description |

|---|---|

| Purpose | Token sales serve as both a fundraising mechanism and a catalyst for a more democratized and decentralized financial system. |

| Technology | Token sales leverage blockchain technology to provide unprecedented levels of transparency, security, and efficiency. |

| Attracting Interest | Token sales attract not only tech enthusiasts and investors but also mainstream businesses and institutions exploring digital asset potential. |

| Global Reach | Token sales break down geographical barriers, allowing global participation and investment opportunities. |

| Financial Ecosystem | This international approach fosters a more interconnected and diverse financial ecosystem, promoting innovation and collaboration. |

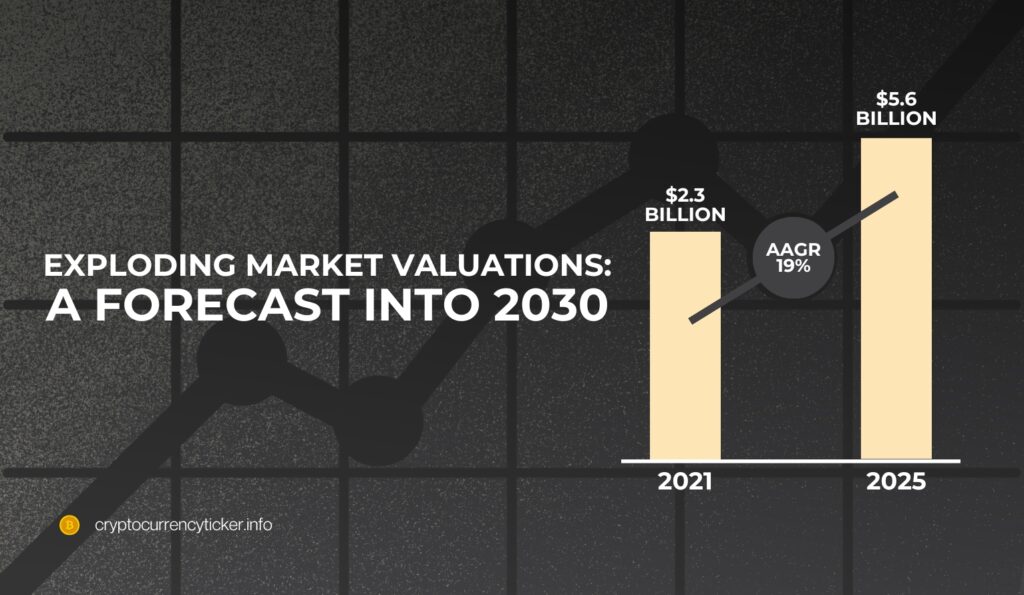

Exploding Market Valuations: A Forecast into 2030

The tokenization market is experiencing an unprecedented expansion, demonstrating a robust growth trajectory. According to Markets & Markets, the value of this market, which stood at $2.3 billion in 2021, is expected to burgeon to $5.6 billion by 2025, showcasing an average annual growth rate of 19%. This escalation is not just confined to traditional financial sectors but spans across various industries, including music, fashion, retail, and sports.

Security tokens, a specific segment of this market, illustrate this growth vividly. In 2021, these tokens reached trading volumes of approximately $4.1 trillion. Projections suggest a staggering increase to $162.7 trillion by 2030. This phenomenal growth can be attributed to their rising adoption in diverse sectors. Security tokens offer a unique blend of traditional asset security and the advantages of digital tokenization, making them increasingly appealing to a wide range of investors and industries.

This surge in market valuation is not an isolated phenomenon. It is supported by several key factors:

- Widening Adoption Across Industries: Tokenization is no longer limited to the financial sector. Industries like entertainment, sports, and fashion are exploring and integrating tokenization, broadening the market significantly.

- Technological Advancements: Continuous improvements in blockchain technology have made tokenization more secure, efficient, and scalable, thereby attracting more stakeholders.

- Regulatory Evolution: As governments and regulatory bodies around the world begin to understand and adapt to the nuances of digital tokens, a more stable and supportive legal framework is emerging, fostering growth in the sector.

- Increasing Investor Interest: With a growing awareness of the benefits of tokenization, such as liquidity, fractional ownership, and global access, investor interest has surged, fueling market growth.

- Innovative Use Cases: The market is witnessing a proliferation of innovative use cases for tokens, ranging from digital art and collectibles to real estate and beyond.

The Surge of Security Tokens and Their Impact

The realm of security tokens is undergoing a transformative phase, marked by an impressive escalation in trading volumes and a broadening spectrum of applications. Security tokens, essentially digital assets that represent ownership in real-world assets, have seen their trading volumes soar to around $4.1 trillion in 2021. The trajectory points to an even more remarkable future, with forecasts predicting these volumes could skyrocket to a staggering $162.7 trillion by 2030. This exponential growth underscores the significant impact security tokens are having on the financial landscape.

Transforming Traditional Financial Markets

Security tokens are not just a new asset class; they represent a fundamental shift in how assets are traded and owned. They blend the benefits of traditional financial securities, like stocks and bonds, with the advantages of blockchain technology, such as immutability, transparency, and global accessibility. This fusion is revolutionizing traditional financial markets in several ways:

- Democratizing Investment: By tokenizing assets, security tokens allow for fractional ownership, making it possible for a wider range of investors to participate in investment opportunities that were previously inaccessible due to high entry barriers.

- Enhanced Liquidity: Security tokens can be traded on specialized exchanges, offering greater liquidity compared to traditional securities. This liquidity is a game-changer, especially for assets like real estate or art, which typically have a longer investment horizon and lower liquidity.

- Global Access: Blockchain technology enables security tokens to be traded across borders with ease, paving the way for a truly global investment market. This global reach allows for a more diverse investor base and increased capital flow.

- Reduced Costs and Increased Efficiency: The use of blockchain in security tokens streamlines many processes in the trading and settlement of securities, leading to reduced costs and increased operational efficiency.

- Regulatory Compliance: Security tokens are designed to comply with regulatory standards, which instills a level of trust and stability in the market. This compliance is essential in attracting institutional investors and maintaining market integrity.

Broader Implications

The surge in security tokens is not just transforming the financial sector; it’s also setting the stage for new investment paradigms. Industries like real estate, art, and even intellectual property are exploring tokenization, offering new opportunities for investment and ownership. As the market continues to evolve, the impact of security tokens is expected to permeate even more sectors, potentially reshaping the global investment landscape.

NFT Revolution: A New Era of Digital Assets

The Non-Fungible Token (NFT) market is experiencing a revolutionary surge, redefining the concept of digital ownership and value. NFTs, unique digital assets verified on a blockchain, have captured the world’s imagination, transcending beyond the realm of cryptocurrency enthusiasts to mainstream consciousness. According to Technavio, the global NFT market is projected to grow by USD 113,933.5 million from 2022 to 2027, at a Compound Annual Growth Rate (CAGR) of 35.02%. This remarkable growth highlights the widespread appeal and potential of NFTs in various sectors.

Impact Across Diverse Sectors

NFTs have made a significant impact in numerous fields, ranging from art and entertainment to sports and gaming. Their unique ability to authenticate and establish ownership of digital content has opened new avenues for creators and collectors alike.

- Art and Collectibles: The art world has been revolutionized by NFTs, allowing digital artists to sell their works as verified, unique pieces. This has democratized art collection, making it accessible to a wider audience and enabling artists to reach global markets directly.

- Entertainment and Music: Musicians and entertainers are utilizing NFTs to create unique, collectible content, offering fans new ways to connect with their work. This includes limited edition releases, digital merchandise, and exclusive experiences.

- Sports Memorabilia: Sports franchises and athletes are leveraging NFTs to offer digital memorabilia, such as trading cards and video highlights, creating a new realm of sports collectibles.

- Gaming: In the gaming industry, NFTs are being used to represent in-game assets, giving players true ownership of their digital items and the ability to trade them outside the game’s ecosystem.

The Value Proposition of NFTs

The value of NFTs lies in their uniqueness and the immutable proof of ownership provided by blockchain technology. Unlike traditional digital files that can be easily copied, NFTs ensure that each item is one-of-a-kind, or part of a limited series, and owned by a specific individual. This uniqueness and verifiable ownership are what drive their value and appeal.

Challenges and Opportunities

While the NFT market is booming, it is not without its challenges. Issues such as environmental concerns related to blockchain technology, the speculative nature of the market, and intellectual property rights are areas that require attention and innovation. However, the opportunities presented by NFTs, especially in terms of creator empowerment and new forms of digital interaction, are immense.

Decentralized Finance (DeFi): The New Frontier

Decentralized Finance, commonly known as DeFi, is rapidly emerging as a transformative force in the financial sector. Rooted in blockchain technology, DeFi represents a shift from traditional, centralized financial systems to a more open, transparent, and accessible model. It is particularly relevant in the context of token sales, where it plays a pivotal role in reshaping investment and financial services.

Growth and Impact in the Blockchain Ecosystem

DeFi has experienced exponential growth, driven by its promise of open access to financial services, irrespective of geographical location or economic status. This growth is not just theoretical; it’s evident in the increasing interest and investments in blockchain, particularly in the financial sector. Analysts and industry researchers have observed a strong focus on cryptocurrency as the “killer app” for blockchain, a trend that underscores the significant role of DeFi.

Key Features of DeFi

- Accessibility and Inclusivity: DeFi platforms allow anyone with an internet connection to access financial services, from trading to lending, without the need for traditional banking infrastructures.

- Transparency and Security: Leveraging blockchain technology, DeFi offers enhanced transparency and security, with every transaction being recorded on a tamper-resistant ledger.

- Innovation in Financial Products and Services: DeFi has led to the creation of innovative financial products, including decentralized exchanges (DEXs), lending platforms, and yield farming, which offer new ways for users to earn interest on their digital assets.

- Smart Contracts: At the core of DeFi are smart contracts, self-executing contracts with the terms of the agreement directly written into code. These contracts automate and enforce financial agreements without intermediaries.

Challenges and Potential

While DeFi offers numerous benefits, it also faces challenges, including regulatory uncertainty, scalability issues, and security vulnerabilities. However, the potential of DeFi to democratize finance, offer new investment opportunities, and innovate financial services remains immense. It is reshaping the landscape of financial transactions and token sales, making them more accessible, efficient, and diverse.

Tokenization Solutions: Meeting the Demand for Security and Efficiency

The global tokenization market is witnessing a rapid growth spurt, propelled by an escalating demand for secure and efficient digital asset management solutions. Tokenization, the process of converting rights to an asset into a digital token on a blockchain, offers a revolutionary approach to handling digital assets. The market for tokenization solutions is expanding swiftly, with predictions indicating it could reach a value of $10 billion by 2023. This growth is a testament to the increasing recognition of the benefits tokenization brings to the table.

Enhancing Security and Efficiency

Tokenization solutions stand at the intersection of security and efficiency, addressing some of the most pressing concerns in the digital asset space. By converting assets into digital tokens, these solutions provide a secure and streamlined way to manage and trade assets on the blockchain. Here are the key benefits:

- Improved Security: Tokenization enhances the security of digital assets by leveraging the inherent security features of blockchain technology, such as decentralization and cryptographic protection. This reduces the risks of fraud and unauthorized access.

- Increased Efficiency: By digitizing assets and transactions, tokenization significantly reduces the time and cost associated with asset management and trading. This efficiency is particularly beneficial in sectors like real estate and finance, where traditional processes can be cumbersome and time-consuming.

- Global Accessibility and Liquidity: Tokenized assets can be traded on global platforms, offering wider accessibility and increased liquidity. This is particularly advantageous for assets traditionally considered illiquid, such as art or real estate.

- Regulatory Compliance: Modern tokenization solutions are increasingly designed to comply with regulatory standards, ensuring that they meet the legal requirements of various jurisdictions. This compliance is crucial for attracting institutional investors and maintaining market integrity.

Diverse Applications Across Sectors

The applications of tokenization are diverse and growing. From real estate and finance to art and intellectual property, various sectors are exploring the potential of tokenized assets. This diversity not only broadens the scope of the tokenization market but also introduces innovative ways of asset management and investment.

Predictions for the Future: What Lies Ahead for Token Sales

As we delve into the future of token sales, it’s evident that this dynamic market is on the cusp of more groundbreaking developments. The rapid evolution of blockchain technology, combined with an increasing appetite for digital assets, sets the stage for an exciting future. Here, we explore expert opinions and predictions on what the next era of token sales might hold.

Continued Market Expansion and Diversification

The token sale market is expected to continue its trajectory of expansion and diversification. As new industries adopt tokenization, the variety and scope of tokens are likely to broaden. This expansion will not only include the financial sector but also extend to realms like art, real estate, entertainment, and even intellectual property.

Technological Innovations and Developments

Blockchain technology is continuously evolving, and with it, the capabilities of token sales are set to enhance. Innovations in scalability, security, and interoperability of blockchain networks will likely make token sales more efficient, accessible, and versatile. Additionally, advancements in areas such as decentralized finance (DeFi) and non-fungible tokens (NFTs) will continue to open new avenues for token sales.

Increased Regulatory Clarity and Compliance

One of the significant trends to watch is the evolution of regulatory frameworks surrounding token sales. As governments and regulatory bodies around the world gain a deeper understanding of digital assets, clearer and more comprehensive regulations are expected to emerge. This increased regulatory clarity will likely lead to greater legitimacy and stability in the market, attracting more institutional investors.

Growing Mainstream Adoption

Token sales are poised to gain more mainstream acceptance and adoption. As the general public becomes more familiar with digital assets and their benefits, token sales will likely see increased participation from a broader demographic. This mainstream adoption will be facilitated by user-friendly platforms and simplified processes that make participating in token sales more accessible to non-technical users.

Challenges and Opportunities

While the future of token sales looks bright, it is not without its challenges. Issues such as market volatility, technological complexities, and the need for more robust security measures will require continuous innovation and adaptation. However, these challenges also present opportunities for growth and improvement, driving the market towards more mature and sophisticated solutions.

Conclusion: Navigating the Future of Token Sales

The future of token sales holds immense promise and is evolving rapidly. We’ve witnessed a significant shift from early cryptocurrency offerings to a diverse and sophisticated token landscape. Key takeaways highlight the market’s growth and diversity, the role of technological advancements, the importance of regulatory frameworks, and the potential for mainstream adoption. As we move forward, challenges and opportunities will continue to shape this domain.

Token sales represent more than just technological advancements; they signify a transformation in how we approach finance, investment, ownership, and value exchange. Embracing this change will be crucial for both seasoned investors and newcomers, as the dynamic world of token sales promises excitement and transformation. Staying informed and adaptable will be the key to success in this evolving market, which marks the culmination of our exploration into the future of token sales.