The world of cryptocurrency has been marked by various innovative and disruptive events, but few have garnered as much attention and controversy as Initial Coin Offerings (ICOs). An ICO is a fundraising mechanism where new projects sell their underlying crypto tokens in exchange for bitcoin and ether. This novel approach to funding emerged as a hybrid of crowdfunding, venture capital, and IPOs, tailored specifically for the digital age.

The Early Beginnings

The concept of ICOs dates back to the early 2010s, with the first notable ICO being that of Mastercoin in 2013. Mastercoin promised to create a new layer on top of Bitcoin to execute smart contracts and tokenize Bitcoin transactions. The project raised an impressive 5,000 BTC in its first ICO. This success paved the way for other projects to follow suit, leading to the birth of a new fundraising mechanism in the crypto space.

The Appeal of ICOs

ICOs quickly gained popularity for several reasons. For startups, they provided a swift and relatively uncomplicated way to raise substantial amounts of capital without the need for traditional investors or the regulatory complexities of an IPO. This was particularly appealing in the blockchain and cryptocurrency sectors, where traditional funding methods were often not as accessible or favorable.

For investors, ICOs presented an opportunity to get in on the ground floor of potentially lucrative projects. Early investment in a successful ICO could lead to significant returns, as seen in some high-profile cases like Ethereum, which raised 18 million dollars in its 2014 ICO and became one of the most valuable cryptocurrencies in terms of market capitalization.

The ICO Landscape: A Quick Overview

- 2013: Mastercoin

- Funds Raised: 5,000 BTC

- 2014: Ethereum

- Funds Raised: $18 million

- 2015: Waves

- Funds Raised: $16 million

- 2016: DAO

- Funds Raised: $150 million

This quick overview illustrates the rapid growth and appeal of ICOs in the early years. Each of these projects brought something new to the table, whether it was Ethereum’s smart contract functionality, Waves’ focus on custom token issuance, or DAO’s ambitious goal of creating a decentralized investment fund.

The introduction of ICOs marked a significant shift in the way startups in the cryptocurrency and blockchain sectors approached funding. Their ability to democratize investments and provide a platform for innovative ideas to receive funding was unparalleled. However, as with any revolutionary concept, ICOs came with their own set of challenges and controversies, which will be explored in the subsequent sections of this article.

The Golden Era of ICOs

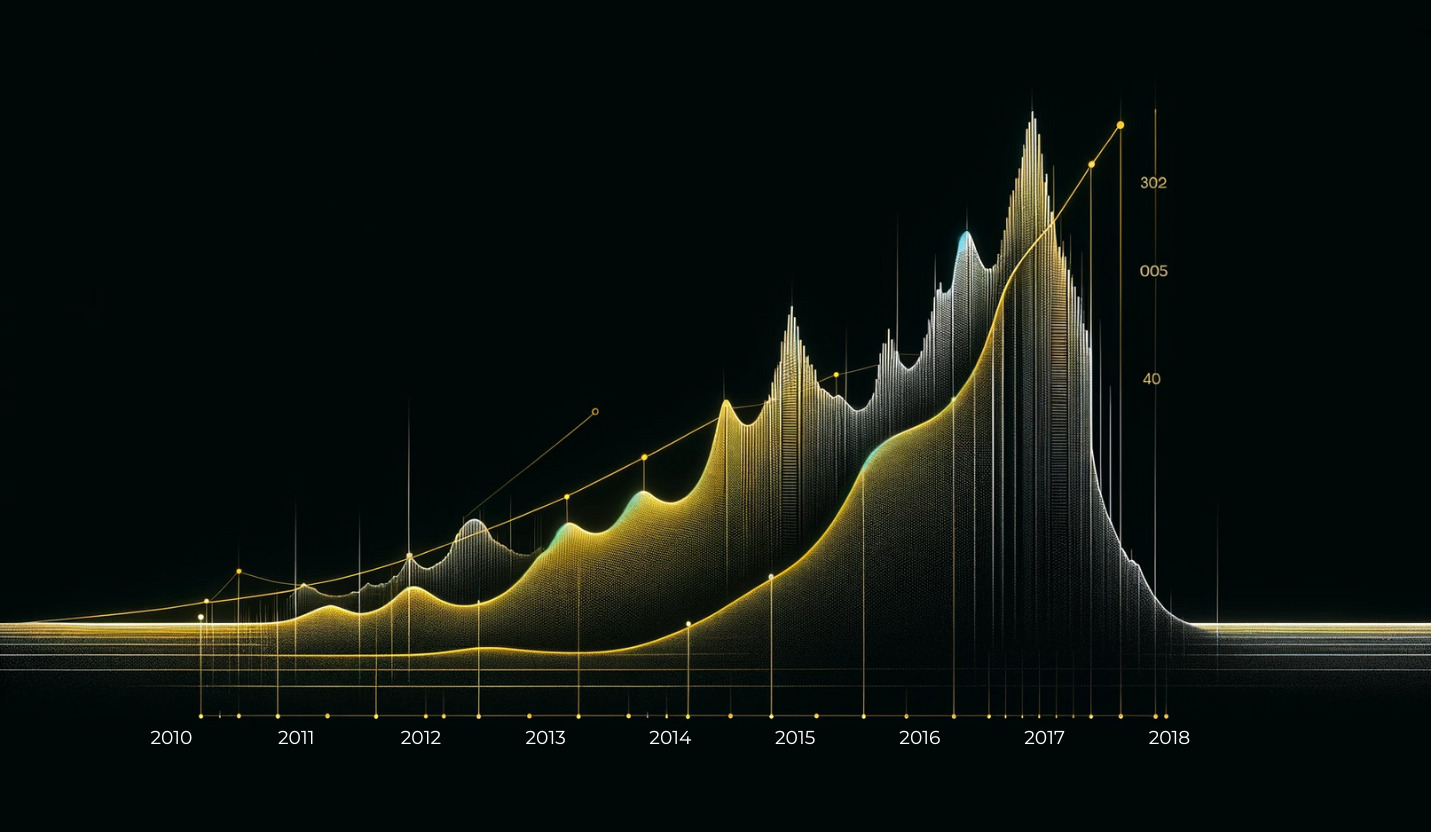

The period between 2016 and 2018 is often referred to as the ‘Golden Era’ of Initial Coin Offerings (ICOs). This phase witnessed an unprecedented surge in the popularity and success of ICOs, fundamentally altering the landscape of fundraising in the cryptocurrency and blockchain sectors.

Surge in Popularity in 2017

The year 2017 marked a watershed moment for ICOs. It was a year characterized by a frenzied rush of investors and startups towards this novel fundraising method. The reason for this surge was twofold: the extraordinary returns from early ICOs like Ethereum, and the booming interest in cryptocurrencies and blockchain technology. This combination created a perfect storm, leading to an explosion in the number and size of ICOs.

Notable Success Stories

During this era, several ICOs achieved remarkable success, raising substantial funds and delivering significant returns to their early investors. Two of the most notable success stories were:

- Ethereum (2014): Often considered the poster child of successful ICOs, Ethereum raised around $18 million. Its platform’s ability to execute smart contracts and create decentralized applications (DApps) set a new standard in the blockchain community.

- Brave (2017): The Brave browser, known for its focus on privacy and ad-blocking, raised $35 million in under 30 seconds in its ICO. This demonstrated the market’s appetite for innovative blockchain-based solutions.

| Year | Notable ICOs | Funds Raised | Key Innovations |

|---|---|---|---|

| 2017 | Filecoin | $257 million | Decentralized storage network |

| 2017 | Tezos | $232 million | Self-amending crypto-ledger |

| 2017 | EOS | $4.1 billion | Scalable smart contract platform |

This table highlights the diversity and ambition of projects funded through ICOs during this period. Each project aimed to leverage blockchain technology to solve real-world problems, from creating decentralized storage solutions to building more scalable blockchain platforms.

Factors Driving the ICO Craze

Several factors contributed to the ICO craze:

- Speculative Investment: The potential for high returns attracted speculative investors, fueling the ICO boom.

- Ease of Participation: Unlike traditional investment avenues, participating in an ICO was relatively easy, requiring just some basic knowledge of cryptocurrencies and a digital wallet.

- Global Reach: ICOs were not confined by geographical boundaries, allowing global participation and investment.

- Marketing and Hype: Aggressive marketing campaigns and media hype played a significant role in attracting investors to ICOs.

The Golden Era of ICOs was marked by a combination of innovation, speculation, and a global wave of enthusiasm for blockchain technology. This period saw some of the most significant fundraising events in the history of cryptocurrencies, setting the stage for both the immense potential and the upcoming challenges of this fundraising method.

The Mechanism Behind ICOs

Understanding the mechanism behind Initial Coin Offerings (ICOs) is crucial to grasp their impact and the reasons behind their rise and fall. At its core, an ICO is a fundraising tool that blends elements of crowdfunding, venture capital, and stock market initial public offerings, but with a distinct technological and regulatory framework.

How ICOs Work

The typical process of an ICO can be broken down into several key steps:

- Idea and Whitepaper: It starts with a startup or team proposing a project, often related to blockchain technology. They publish a whitepaper detailing the project’s concept, technology, application, and how the funds will be used.

- Token Creation: The project creates digital tokens or coins, which are sold to raise funds. These tokens often grant holders some rights related to the project, such as usage rights, voting rights, or a share in future profits.

- Public Sale: The tokens are offered to the public, usually in exchange for established cryptocurrencies like Bitcoin or Ethereum. This phase can vary in duration and may include pre-sales or private sales with different terms.

- Token Distribution and Listing: Following the sale, investors receive their tokens. These tokens can then be listed on cryptocurrency exchanges, enabling their trading on the open market.

The Role of Cryptocurrencies in ICOs

Cryptocurrencies play a pivotal role in ICOs, serving as the primary medium of exchange. Investors use cryptocurrencies to purchase the new ICO tokens. This reliance on cryptocurrencies like Bitcoin and Ethereum links the success and behavior of ICOs closely to the broader crypto market dynamics.

| Aspect | ICOs | Traditional Funding |

|---|---|---|

| Access to Capital | Global, with fewer barriers | Often geographically limited |

| Regulatory Oversight | Initially minimal | Stringent regulations |

| Investor Base | Broad and decentralized | More centralized and institutional |

| Speed of Funding | Can be very rapid | Typically slower and more structured |

| Risk and Speculation | High, with less predictability | More predictable with established frameworks |

This table contrasts ICOs with traditional funding methods, highlighting the unique characteristics that made ICOs both appealing and risky.

Challenges in the ICO Mechanism

While the ICO mechanism opened up new avenues for fundraising, it also faced several challenges:

- Regulatory Uncertainty: The lack of clear regulations in the early stages led to a wild-west scenario, where projects operated in a largely unregulated space.

- Risk of Fraud: The ease of launching an ICO, combined with minimal oversight, led to numerous scams and fraudulent projects.

- Market Volatility: The dependence on cryptocurrencies meant that ICOs were susceptible to the highly volatile nature of the crypto markets.

The mechanism behind ICOs represented a significant shift in how startups could access funding, democratizing investment opportunities but also introducing new risks and challenges. The next sections will delve into the regulatory responses and the eventual challenges that led to the decline of the ICO craze.

Regulatory Challenges and Legal Hurdles

The rapid rise of Initial Coin Offerings (ICOs) caught the attention of regulators worldwide. Initially operating in a regulatory gray area, ICOs soon faced increasing scrutiny as governments and financial authorities began to recognize the potential risks associated with this new form of fundraising.

The Lack of Regulation and Its Implications

In the early days of ICOs, there was a significant lack of regulatory oversight. This absence of clear rules and standards led to a proliferation of ICOs, many of which were launched with little more than a whitepaper and a website. The lack of regulation opened the door for fraudulent activities, including scams where project creators disappeared with investors’ funds, and projects that were poorly conceived or executed.

Global Regulatory Responses to ICOs

Different countries responded to the ICO phenomenon in various ways, reflecting their attitudes towards cryptocurrencies and digital assets. Here are some notable examples:

- United States: The U.S. Securities and Exchange Commission (SEC) took a cautious approach, deeming that many ICOs were, in fact, securities offerings and thus subject to federal securities laws. This led to several high-profile investigations and actions against non-compliant ICOs.

- China: China took a more stringent approach, outright banning ICOs in 2017 as part of a broader crackdown on cryptocurrencies. This move was a significant blow to the ICO market, given China’s role as a major player in the crypto space.

- European Union: The EU has been working towards creating a balanced regulatory framework. While it has not banned ICOs, it has issued warnings about the risks associated with them and is working on regulations to protect investors while fostering innovation.

The Impact of Regulation on ICOs

The increasing regulatory pressure had several effects on the ICO market:

- Decrease in ICO Launches: The number of new ICOs started to decline as regulatory hurdles made it more difficult and risky to launch an ICO.

- Shift to Security Token Offerings (STOs): Many projects started to consider STOs, which are similar to ICOs but are explicitly designed to comply with securities laws.

- Increased Focus on Compliance: Projects that continued with ICOs had to put more effort into legal compliance, often leading to higher costs and longer preparation times.

The regulatory challenges and legal hurdles faced by ICOs significantly altered the landscape. While these developments helped weed out fraudulent and unserious projects, they also raised the barriers to entry, marking the beginning of a new, more regulated era for digital token offerings.

The ICO Bubble: Signs and Causes

The period of rapid growth and enthusiasm around Initial Coin Offerings (ICOs) eventually led to what many analysts describe as a ‘bubble’. This phase was characterized by a massive influx of projects, some of which were not grounded in viable business models or realistic goals. Understanding the signs and causes of this bubble is crucial for a comprehensive historical perspective on ICOs.

The Peak of ICO Frenzy

The ICO frenzy reached its peak around late 2017 and early 2018. This period saw a dramatic increase in the number of ICOs, with billions of dollars being raised. However, this rapid growth was not sustainable. Many projects failed to deliver on their promises, and the market became saturated with tokens that had little to no real-world utility.

Factors Leading to the Bubble

Several factors contributed to the formation of the ICO bubble:

- Speculative Investment: The success of early ICOs sparked a frenzy among investors, driven largely by the fear of missing out (FOMO) on potentially high returns. This led to irrational investment behaviors and speculation.

- Lack of Due Diligence: The excitement around ICOs often overshadowed the need for thorough due diligence. Many investors poured money into projects without a proper understanding of their feasibility or the team behind them.

- Market Overconfidence: There was a general overconfidence in the market that every blockchain project would be successful, ignoring the inherent risks and challenges of such ventures.

- Inadequate Regulatory Frameworks: The initial lack of regulation allowed for the unchecked growth of ICOs, including many that were not credible or were outright scams.

The ICO Bubble Burst: A Timeline

- 2018: Market Correction

- Impact: Sharp decline in cryptocurrency values, affecting the ICO market.

- 2018: Increased Regulatory Scrutiny

- Impact: Closure of many ICOs and heightened investor caution due to regulatory actions.

- 2019: Market Saturation and Investor Disillusionment

- Impact: Further decline in new ICO launches, as the market faced oversaturation and investors became more skeptical.

This timeline highlights the key events that marked the bursting of the ICO bubble. The market correction in 2018, coupled with regulatory crackdowns, led to a significant cooling-off in the ICO market.

The Aftermath of the Bubble

The aftermath of the ICO bubble was marked by a more cautious and skeptical approach towards ICOs. Investors became more discerning, and projects had to demonstrate more substantial and realistic business models. The market shift also led to the emergence of new fundraising mechanisms, such as Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs), which sought to address some of the shortcomings of traditional ICOs.

The ICO bubble was a complex phenomenon driven by a mix of speculation, market overconfidence, and regulatory gaps. Its burst led to a significant reevaluation of the ICO model and paved the way for more sustainable and regulated forms of crypto-based fundraising.

The Downfall: Scams, Frauds, and Market Saturation

The decline of the Initial Coin Offering (ICO) market was not solely due to regulatory crackdowns and the bursting of the bubble. A significant factor contributing to the downfall was the prevalence of scams, frauds, and the eventual market saturation. This phase of the ICO lifecycle is critical to understand, as it highlights the risks inherent in emerging, unregulated markets.

High-Profile Scams and Their Impact

The ICO boom attracted not only genuine entrepreneurs and investors but also opportunists and fraudsters. The lack of regulation and the ease of launching ICOs made it a fertile ground for scams. Some projects made grandiose promises with little to no intention of delivering, while others were outright Ponzi schemes. High-profile scams not only led to substantial financial losses for investors but also severely damaged the reputation of ICOs as a legitimate fundraising mechanism.

Notable ICO Scams:

- Pincoin and iFan: These two ICOs, run by the same Vietnam-based company, raised $660 million from approximately 32,000 people before the operators disappeared.

- Centra Tech: Endorsed by celebrities, this ICO raised $32 million, promising to develop a cryptocurrency debit card. The founders were later charged with fraud.

The Role of Market Saturation in the Decline

As more and more ICOs flooded the market, it became increasingly difficult for individual projects to stand out. Many projects were variations of existing ones, offering little in terms of innovation or unique value propositions. This saturation led to investor fatigue and a decrease in the overall quality of projects, making it harder for even legitimate ICOs to attract funding.

The Numbers: ICOs and Scams

- 2017

- Number of ICOs: Over 900

- Estimated Funds Lost to Scams: $100 million+

- 2018

- Number of ICOs: Over 1,200

- Estimated Funds Lost to Scams: $1 billion+

This list illustrates the rapid growth in the number of ICOs and the corresponding increase in funds lost to scams.

The Consequences of Scams and Saturation

The consequences of these scams and the oversaturated market were far-reaching:

- Loss of Investor Confidence: Investors became more cautious, leading to a decline in funding for new ICOs.

- Increased Regulatory Scrutiny: These events drew the attention of regulators worldwide, hastening the implementation of stricter regulations.

- Shift in Fundraising Models: The decline in ICO popularity led to the rise of alternative models like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs), which aimed to address some of the shortcomings of ICOs.

The downfall of ICOs was a multifaceted issue. While the regulatory challenges and the bursting of the bubble played significant roles, the prevalence of scams and market saturation were equally critical in undermining the credibility and viability of ICOs as a fundraising tool.

The Aftermath and Future of ICOs

In the wake of the ICO boom and bust, the landscape of cryptocurrency fundraising has undergone significant changes. This final section explores the aftermath of the ICO era and speculates on the future trajectory of this innovative yet controversial fundraising mechanism.

The Current State of ICOs

Post-2018, the ICO market has seen a marked decline in both the number of offerings and the total capital raised. This downturn can be attributed to several factors:

- Increased Regulatory Oversight: With more stringent regulations in place, launching an ICO has become more complex and costly, deterring many potential projects.

- Investor Wariness: The high incidence of scams and failed projects during the ICO boom has made investors more cautious and skeptical.

- Market Maturation: As the cryptocurrency market matures, there is a growing preference for more regulated and structured forms of investment, such as STOs and IEOs.

The Evolution of ICOs

Despite their reduced popularity, Initial Coin Offerings (ICOs) are evolving to meet new market demands. This evolution features a stronger emphasis on regulatory compliance, aiming to rebuild the investor trust compromised during the ICO boom. Modern ICOs are also shifting towards quality, emphasizing viable business models, experienced teams, and clear value propositions. Additionally, there’s a trend towards integrating ICOs with traditional financial systems, balancing innovation with regulatory adherence, and aligning these fundraising methods more closely with conventional financial norms.

The Future Outlook

Looking ahead, several key trends are likely to shape the future of ICOs:

- Regulatory Clarity: As regulations around digital assets continue to evolve, ICOs that comply with these regulations will likely find a more receptive market.

- Technological Advancements: Continued innovation in blockchain and related technologies may open new possibilities for ICOs, potentially reviving interest in this fundraising model.

- Niche Markets: ICOs may find a sustainable future in niche markets or specific sectors where the traditional fundraising mechanisms are less effective.

ICOs: A Historical Perspective

The history of Initial Coin Offerings (ICOs) encompasses distinct phases, each shaping the digital fundraising landscape. Pre-2017, the emergence phase saw ICOs innovating and gaining early traction. The 2017-2018 boom brought rapid growth and high investment, marred by prevalent scams. The 2018-2019 bust phase led to market corrections and regulatory crackdowns. Post-2019, ICOs entered a maturation phase, marked by increased regulation and a focus on quality and compliance, reflecting a more cautious approach shaped by past experiences.

While the heyday of ICOs as a dominant fundraising tool may be over, they continue to exist in a more regulated and refined form. The lessons learned from the rise and fall of ICOs have been instrumental in shaping the current and future landscape of cryptocurrency fundraising.

Conclusion: Lessons Learned and the Way Forward

The ICO era, a tumultuous chapter in the history of digital finance, has imparted crucial lessons about the intersection of innovation, regulation, and market dynamics. This period showcased the transformative potential of blockchain for fundraising, while simultaneously highlighting the perils of unregulated financial activities. The key takeaway is the paramount importance of regulatory frameworks, which not only protect investors but also sustain market integrity. The saga of ICOs underlines the necessity for investor education and due diligence, emphasizing that sustainable business models should take precedence over transient hype. It also reminds us that while innovation is essential for progress, it invariably comes with its share of risks.

Looking ahead, the legacy of ICOs is shaping the future of digital fundraising. The emergence of regulated alternatives like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs) reflects a market that is learning from the past, striving for a balance between innovation and investor protection. The integration of blockchain-based fundraising with traditional financial systems marks a significant step towards a more inclusive and regulated financial environment. As the blockchain and cryptocurrency space continues to evolve, new models like Decentralized Finance (DeFi) and Non-Fungible Token (NFT) sales are emerging, each carrying forward the lessons from the ICO era. This ongoing evolution is a testament to the enduring impact of ICOs on the landscape of digital fundraising.