The world of cryptocurrency trading is a dynamic and exhilarating arena, offering opportunities for significant financial gains, but not without its fair share of risks. This guide aims to equip both novice and experienced traders with the essential strategies needed to navigate the complex and often volatile crypto market successfully.

The Allure of Cryptocurrency Trading

Cryptocurrency trading has captivated the attention of investors worldwide, thanks to its unique blend of technology, finance, and the promise of decentralization. Unlike traditional financial markets, the crypto market operates 24/7, offering continuous opportunities for trading. This market is known for its high volatility, which, while risky, also presents chances for substantial profits.

The Evolution of the Crypto Market

The crypto market has evolved significantly since the inception of Bitcoin in 2009. Initially viewed as a niche interest for tech enthusiasts, it has now grown into a global phenomenon with a market capitalization running into trillions of dollars. This growth has been fueled by the increasing acceptance of cryptocurrencies as a legitimate asset class, the rise of blockchain technology, and the entry of institutional investors into the space.

Key Milestones in Crypto Market Evolution:

- 2009: Launch of Bitcoin, the first decentralized cryptocurrency.

- 2013-2014: Emergence of altcoins (alternative cryptocurrencies to Bitcoin).

- 2017: Initial Coin Offerings (ICOs) boom, leading to a significant market expansion.

- 2020-2021: Increased institutional investment and mainstream adoption.

Current State of the Crypto Market

As of now, the crypto market is more diverse than ever, with thousands of cryptocurrencies available for trading. This diversity includes not just currencies but also tokens representing a range of assets and utilities, from digital art (NFTs) to decentralized finance (DeFi) applications.

Market Diversity: A Snapshot

- Cryptocurrencies: Bitcoin, Ethereum, Ripple, etc.

- Tokens: DeFi tokens, NFTs, utility tokens.

- Market Trends: Growing interest in DeFi, NFTs, and sustainable crypto mining.

Why Understanding the Crypto Market is Crucial

For traders, understanding the crypto market’s nuances is crucial. This includes being aware of market trends, regulatory changes, technological advancements, and the economic factors influencing cryptocurrencies. A deep understanding helps in making informed trading decisions, essential for success in this rapidly changing environment.

Understanding the Crypto Market

To excel in crypto trading, one must first understand the unique characteristics of the cryptocurrency market. This market differs significantly from traditional financial markets, and these differences can have a profound impact on trading strategies.

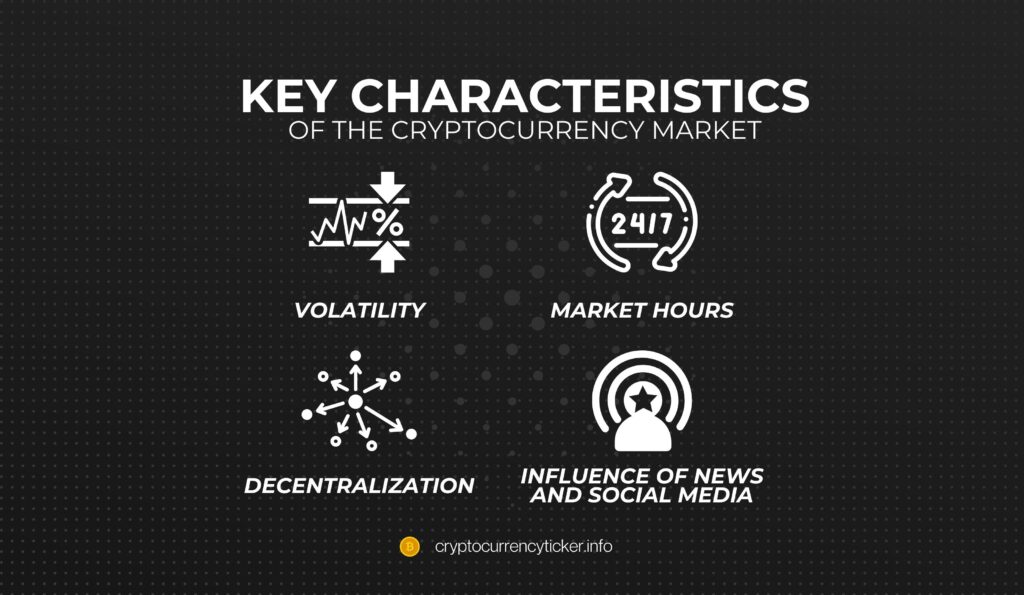

Key Characteristics of the Cryptocurrency Market

The cryptocurrency market is distinguished by several key features:

- Volatility: Cryptocurrencies are known for their rapid price fluctuations. This volatility can be attributed to factors like market sentiment, regulatory news, technological developments, and macroeconomic trends.

- Market Hours: Unlike traditional markets, the crypto market operates 24/7, offering constant trading opportunities but also demanding more vigilance from traders.

- Decentralization: Many cryptocurrencies operate on decentralized networks, which can lead to less predictability and more price variation due to the lack of centralized control.

- Influence of News and Social Media: The crypto market is highly sensitive to news and social media, often reacting swiftly to announcements, rumors, or influential opinions.

How Crypto Markets Differ from Traditional Markets

Comparing crypto markets to traditional financial markets reveals several contrasts:

| Feature | Crypto Market | Traditional Market |

|---|---|---|

| Operation Hours | 24/7 | Limited trading hours |

| Volatility | High | Relatively lower |

| Influence | News, social media | Economic indicators, corporate performance |

| Accessibility | Global, with few barriers | Often regulated with higher barriers |

| Asset Types | Digital assets | Stocks, bonds, commodities |

The Importance of Market Analysis

Successful crypto trading hinges on effective market analysis, which includes both fundamental and technical analysis. Fundamental analysis involves evaluating a cryptocurrency’s underlying value, considering factors like technology, team, market demand, and regulatory environment. Technical analysis, on the other hand, focuses on price movements and trading volumes to identify patterns and predict future trends.

Staying Informed: The Key to Success

Given the fast-paced nature of the crypto market, staying informed is crucial. This involves:

- Regularly following crypto news sources and forums.

- Using social media to gauge market sentiment.

- Attending webinars, conferences, and workshops.

- Networking with other traders and industry experts.

Fundamental Analysis in Crypto Trading

Fundamental analysis is a cornerstone of successful crypto trading. It involves a deep dive into the intrinsic value of cryptocurrencies, beyond just price trends and market sentiment. This section explores the key aspects of fundamental analysis in the crypto world.

Understanding the Value Behind Cryptocurrencies

At the heart of fundamental analysis is the quest to understand what gives a cryptocurrency its value. This involves examining several factors:

- Technology: The underlying technology of a cryptocurrency, such as its blockchain architecture, scalability, security features, and any unique technological innovations.

- Development Team: The expertise and track record of the team behind the cryptocurrency can significantly impact its success and credibility.

- Market Demand: The current and potential demand for the cryptocurrency, influenced by factors like use cases, adoption rate, and community support.

- Regulatory Environment: How regulations and legal considerations in different countries could affect the cryptocurrency’s adoption and value.

Evaluating Cryptocurrencies: Key Factors to Consider

When evaluating a cryptocurrency for investment or trading, consider the following:

- Whitepaper and Roadmap: A thorough review of the project’s whitepaper and roadmap provides insights into its purpose, technology, and future plans.

- Tokenomics: Understanding the token’s supply, distribution, and economic model is crucial. This includes factors like total supply, circulation, and how tokens are used within the ecosystem.

- Community and Ecosystem: A strong, active community and a growing ecosystem of partnerships and applications can be indicators of a healthy cryptocurrency project.

- Competitive Positioning: Analyzing how the cryptocurrency stands against its competitors in terms of technology, adoption, and market position.

Tools for Fundamental Analysis

Traders can leverage various tools and resources for fundamental analysis, including:

- Cryptocurrency News Websites: For staying updated with the latest developments.

- Blockchain Explorers: To analyze transaction data and network activity.

- Community Forums and Social Media: For insights into community sentiment and discussions.

- Financial Reports and Analysis: From experts and market analysts.

Technical Analysis for Predicting Market Trends

While fundamental analysis focuses on a cryptocurrency’s intrinsic value, technical analysis is all about studying market activity, primarily through the use of charts and statistical indicators. This section will explore how traders can use technical analysis to predict market trends and make informed trading decisions.

Basics of Technical Analysis in Crypto Trading

Technical analysis in crypto trading involves examining price movements and trading volumes to identify patterns and trends. This approach is based on the idea that historical trading activity and price changes can be valuable indicators of future market behavior.

Key Components of Technical Analysis:

- Price Charts: Understanding different types of charts (like line, bar, and candlestick charts) is fundamental.

- Volume Analysis: Volume, the amount of a cryptocurrency traded over a given period, can indicate the strength of a price movement.

- Trend Lines and Patterns: Identifying trends and patterns in price movements to predict future market behavior.

Popular Technical Indicators and Their Use

Several technical indicators are widely used in crypto trading. Some of the most popular include:

- Moving Averages (MA): Indicate the average price over a specific period, helping to smooth out price volatility and identify trends.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Bollinger Bands: Consist of an upper band, lower band, and moving average, indicating the level of volatility in the market.

- Fibonacci Retracement: A tool used to identify potential support and resistance levels based on Fibonacci ratios.

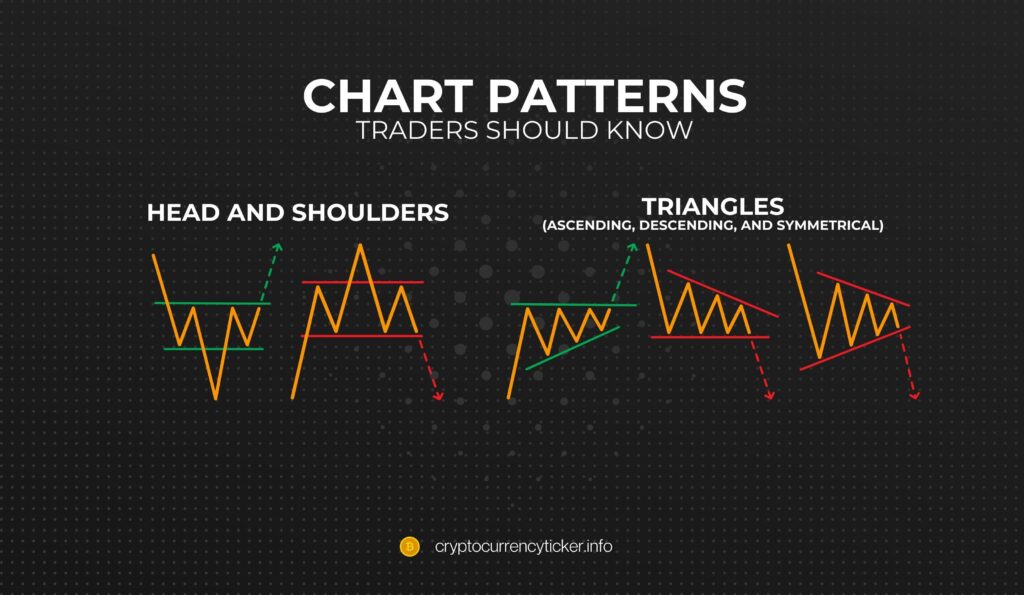

Chart Patterns Traders Should Know

Recognizing chart patterns is crucial in technical analysis. Some common patterns include:

- Head and Shoulders: Indicates a reversal of a current trend.

- Triangles (Ascending, Descending, and Symmetrical): Suggest continuation or reversal depending on the breakout direction.

- Cup and Handle: A bullish signal indicating a price rise.

Combining Technical Analysis with Other Strategies

While technical analysis is powerful, it’s most effective when combined with other strategies, such as fundamental analysis and risk management. This holistic approach can provide a more comprehensive view of the market.

Tools and Resources for Technical Analysis

Traders can utilize various tools and platforms for technical analysis, including:

- Trading Platforms with Analytical Tools: Many platforms offer built-in tools for charting and analysis.

- Dedicated Technical Analysis Software: For more advanced analysis.

- Educational Resources: Books, courses, and online tutorials to learn more about technical analysis.

Risk Management in Cryptocurrency Trading

Effective risk management is crucial in the volatile world of cryptocurrency trading. It involves identifying, assessing, and mitigating the risks associated with market fluctuations. This section will guide you through the strategies to manage risk and protect your investments.

Understanding the Risks in Crypto Trading

Before diving into risk management strategies, it’s important to understand the types of risks involved in crypto trading:

- Market Risk: The risk of losses due to market conditions.

- Liquidity Risk: The risk that an asset cannot be bought or sold quickly enough to prevent a loss.

- Operational Risk: Risks arising from operational failures, such as trading platform issues or transaction errors.

- Regulatory Risk: The impact of regulatory changes on cryptocurrency markets.

Strategies for Managing Risk

To mitigate these risks, traders should employ a variety of strategies:

- Diversification: Spreading investments across different cryptocurrencies can reduce the impact of a decline in any single asset.

- Position Sizing: Investing only a small percentage of the total portfolio in a single trade to limit potential losses.

- Stop-Loss and Take-Profit Orders: Setting automatic orders to sell assets at certain price levels to manage potential losses and lock in profits.

- Regular Market Analysis: Keeping up-to-date with market trends and adjusting strategies accordingly.

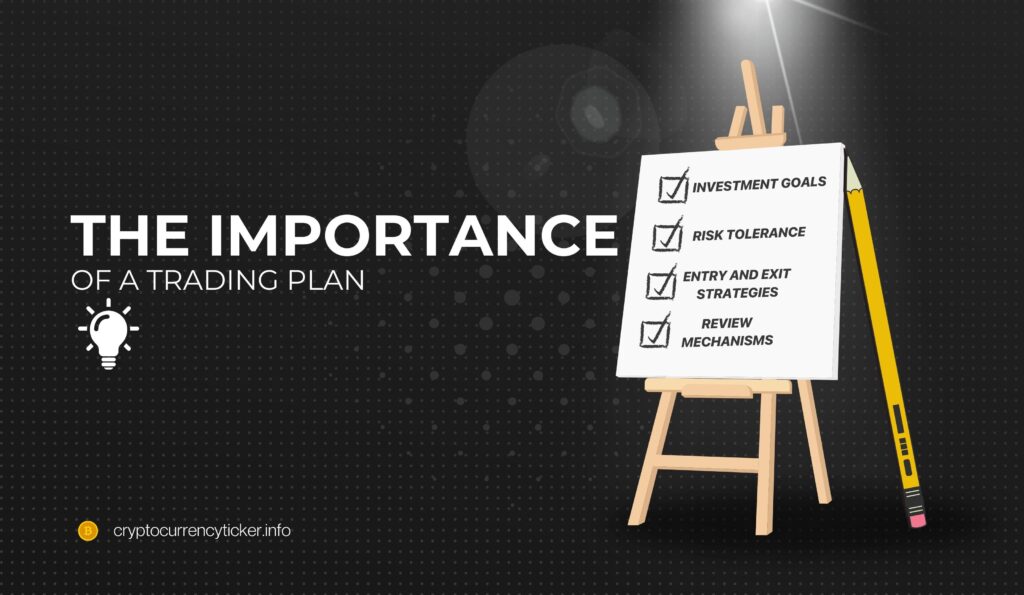

The Importance of a Trading Plan

A well-defined trading plan is essential for effective risk management. This plan should include:

- Investment Goals: Clear objectives for trading activities.

- Risk Tolerance: An understanding of how much risk you are willing to take.

- Entry and Exit Strategies: When and how you will enter and exit trades.

- Review Mechanisms: Regularly reviewing and adjusting the plan based on market performance.

Tools for Risk Management

Several tools can aid in risk management:

- Risk Management Software: Tools that help in calculating risks and setting appropriate stop-loss orders.

- Portfolio Management Apps: For tracking and managing your investments across various platforms.

- Educational Resources: Learning about risk management strategies from books, courses, and experienced traders.

Psychology of Trading: Staying Rational

The psychological aspect of trading, often overlooked, plays a crucial role in the success of cryptocurrency traders. This section delves into the emotional challenges of trading and offers strategies to maintain a rational and disciplined approach.

Emotional Challenges in Trading

Trading cryptocurrencies can be an emotional rollercoaster, with rapid price fluctuations leading to feelings of excitement, fear, and greed. Common emotional challenges include:

- Fear of Missing Out (FOMO): The anxiety that leads to impulsive buying during market rallies, often resulting in buying at peak prices.

- Fear, Uncertainty, and Doubt (FUD): Negative emotions and doubts that can lead to panic selling during market downturns.

- Overconfidence: After a few successful trades, traders might become overconfident, leading to risky decisions.

Maintaining a Clear Mind

To combat these emotional challenges, traders should:

- Develop a Trading Plan: Stick to a well-thought-out plan to avoid impulsive decisions.

- Set Realistic Goals: Understand that not all trades will be profitable and set achievable targets.

- Practice Emotional Discipline: Recognize emotional responses and learn to pause and reassess situations objectively.

- Continuous Learning: Stay informed and educated about market trends and trading strategies.

Avoiding Common Pitfalls

Several common pitfalls can be avoided with the right mindset:

- Chasing Losses: Trying to recover losses quickly often leads to more risky and uncalculated decisions.

- Underestimating Market Volatility: Always be prepared for sudden market changes and have contingency plans.

- Ignoring Market Signals: Overreliance on one’s own beliefs about the market, ignoring actual market signals and data.

Tools and Techniques for Psychological Resilience

Building psychological resilience is key to successful trading. Some techniques include:

- Meditation and Mindfulness: To maintain calm and clarity.

- Journaling Trades: Keeping a record of trades and emotional states to identify patterns.

- Networking with Other Traders: Sharing experiences and strategies can provide emotional support and practical advice.

Leveraging Trading Tools and Platforms

In the fast-paced world of cryptocurrency trading, having the right tools and platforms at your disposal can make a significant difference. This section explores the various technologies and resources available to traders, helping them to make more informed and efficient trading decisions.

Overview of Popular Trading Tools and Platforms

The cryptocurrency market offers a wide range of trading tools and platforms, each with unique features and functionalities. Some of the most popular include:

- Exchange Platforms: Platforms like Binance, Coinbase, and Kraken offer user-friendly interfaces, a variety of cryptocurrencies, and different trading options.

- Charting Tools: Tools like TradingView and Coinigy provide advanced charting capabilities for technical analysis.

- Automated Trading Bots: Bots like 3Commas and Cryptohopper enable automated trading based on specific algorithms and market indicators.

- Portfolio Trackers: Apps like Blockfolio and Delta help traders track their portfolio balance and performance across multiple exchanges.

Choosing the Right Tools for Your Trading Style

Selecting the right tools depends on your trading style, experience level, and specific needs. Consider the following when choosing:

- User Interface: Look for platforms with intuitive interfaces, especially if you’re a beginner.

- Security Features: Prioritize platforms with robust security measures.

- Asset Variety: Ensure the platform supports a wide range of cryptocurrencies and trading pairs.

- Fee Structure: Be aware of the fees associated with trading and withdrawals.

- Customer Support: Reliable customer support is crucial, especially in a market that operates 24/7.

Integrating Tools for Optimal Trading

Effective trading involves integrating various tools. For instance, you might use an exchange platform for trading, a charting tool for technical analysis, and a portfolio tracker to monitor overall performance. This integrated approach can provide a comprehensive view of the market and your investments.

Staying Updated with New Tools and Features

The crypto trading landscape is constantly evolving, with new tools and features being introduced regularly. Staying updated with these developments can give you a competitive edge. Follow industry news, participate in online forums, and join trading communities to stay informed.

Advanced Strategies: Margin and Futures Trading

For traders looking to elevate their crypto trading strategies, margin and futures trading offer opportunities for significant gains, albeit with increased risks. This section delves into these advanced trading strategies, highlighting their potential and the caution needed to navigate them successfully.

Understanding Leverage in Margin Trading

Margin trading involves borrowing funds to increase potential returns on a trade. It’s a practice that allows traders to open larger positions than their existing capital would permit.

- Leverage: This is the key concept in margin trading, where you can trade larger amounts of capital than you own. For example, with a 10:1 leverage, you can trade $10,000 worth of cryptocurrencies with just $1,000.

- Risks: While leverage can amplify profits, it also magnifies losses. A small price movement in the wrong direction can lead to significant losses, potentially exceeding the initial investment.

Futures Trading in Cryptocurrency

Futures trading involves buying or selling a cryptocurrency at a predetermined price at a specific future date, regardless of the market price at that time.

- Hedging and Speculation: Futures can be used for hedging against price volatility or for speculation to profit from price movements.

- Contracts: Futures are traded in the form of contracts, which obligate the buyer to purchase, or the seller to sell, the asset at the agreed-upon price on the contract’s expiration date.

Strategies for Margin and Futures Trading

To navigate these advanced trading strategies, consider the following:

- Start Small: Begin with smaller amounts to understand the mechanics and risks involved.

- Use Stop-Loss Orders: Protect your positions from significant losses with stop-loss orders.

- Continuous Market Analysis: Stay informed about market trends and adjust your strategies accordingly.

- Risk Management: Allocate only a portion of your portfolio to these high-risk strategies.

The Importance of Understanding Market Sentiment

Market sentiment plays a crucial role in margin and futures trading. Understanding the general mood of the market can help in making more informed decisions, especially in these high-stakes trading strategies.

Tools for Advanced Trading Strategies

Several tools can assist in margin and futures trading:

- Risk Assessment Tools: To calculate potential losses and gains.

- Advanced Trading Platforms: Platforms that offer detailed analysis and tools specifically for margin and futures trading.

- Educational Resources: Learning from experienced traders and specialized courses can provide deeper insights into these advanced strategies.

Staying Updated: Continual Learning and Adaptation

The cryptocurrency market is renowned for its rapid evolution and constant innovation. For traders, this means that continual learning and adaptation are not just beneficial but necessary for sustained success. This final section emphasizes the importance of staying informed and agile in the ever-changing landscape of crypto trading.

The Importance of Continuous Education

In a field as dynamic as cryptocurrency trading, what worked yesterday might not work tomorrow. Continuous education is key to keeping up with new developments, understanding emerging trends, and refining trading strategies. This involves:

- Staying Informed About Market Changes: Regularly following news, market analyses, and updates in the crypto world.

- Learning from Mistakes: Analyzing both successful and unsuccessful trades to understand what worked and what didn’t.

- Exploring New Strategies and Technologies: Being open to experimenting with new trading strategies and technologies.

Resources for Continuous Learning

A wealth of resources is available for traders looking to expand their knowledge:

- Online Courses and Webinars: Many platforms offer courses ranging from beginner to advanced levels.

- Books and E-books: Written by experts, these can provide in-depth insights into various aspects of crypto trading.

- Forums and Online Communities: Engaging with other traders can offer practical tips and shared experiences.

- Conferences and Workshops: These events are opportunities to learn from experts and network with other traders.

Adapting to Market Changes

The ability to adapt to market changes is a crucial trait for a successful trader. This includes:

- Being Flexible with Strategies: Willingness to change trading strategies in response to market conditions.

- Risk Management Adaptation: Adjusting risk management approaches as the market evolves.

- Embracing Technological Advancements: Utilizing new tools and platforms that emerge in the market.

The Role of Innovation in Trading

Innovation in blockchain and cryptocurrency technologies is relentless, and traders need to be aware of these changes. This includes understanding new cryptocurrencies, blockchain upgrades, and the impact of regulatory changes.

Conclusion: Building a Sustainable Trading Approach

In the dynamic world of crypto trading, building a sustainable trading approach is essential. This involves combining a deep understanding of both fundamental and technical analysis, prioritizing robust risk management, and maintaining emotional discipline. A sustainable approach also means leveraging the right tools and platforms to enhance trading efficiency and staying informed and adaptable to the ever-evolving market trends. Discipline and information are the cornerstones of this approach, requiring traders to adhere to a clear trading plan, engage in continuous learning, and network with peers for shared insights and strategies.

Patience and persistence are key virtues in the realm of trading. Success in cryptocurrency trading often comes from the ability to endure the market’s ups and downs while focusing on long-term goals. Preparing for the future involves being open to new opportunities, adapting to regulatory changes, and maintaining a focus on long-term objectives rather than short-term gains. By embracing these principles, traders can navigate the complexities of the crypto market with confidence and resilience, ensuring a balanced, informed, and adaptable approach for long-term success.